Why all the crypto raids?

In today’s edition, Dubai’s got rules, Aave hits pause, and Elon wants help.

Welcome to The Daily Moon. GoTo doesn’t have FOMO anymore. Indonesia’s biggest technology company, GoTo, has entered the crypto space by acquiring local exchange Kripto Maksima Koin. Everyone wants a piece of it.

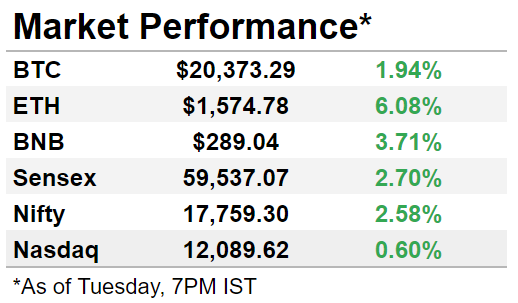

The markets were in the green. Bitcoin rose above $20,000 and Ethereum crossed the $1,570 mark. Nasdaq was up in early trade. Back home, Sensex and Nifty gained on the back of BFSI stocks.

Indian Crypto Exchanges Are Hurting

Crypto exchanges in India are suffering. India’s financial crimes investigator, Enforcement Directorate, has started investigations on most major exchanges in the country. What’s the deal? Let’s break it down.

The question

The agency says that it will probe allegations of money laundering. It believes that there is not enough transparency when it comes to the KYC of its customers. And it has seized the bank assets of Vauld and WazirX. Bengaluru-based Yellow Tune Technologies’ bank balance worth Rs 370 crore has been held up.

Money laundering is serious

It is serious, but the link is a little tenuous. Let’s walk through it. You see, there were these Chinese lending apps, which have been on the watchlist of several investigative agencies in India. Lawmakers believe that the loaned cash is recovered and sent out of the country almost immediately. Cash worth Rs 1,000 crore has allegedly left Indian shores. Now, investigators suspect that these lending apps used crypto to move money out of India. The question is, how much did these exchanges know?

Did they know?

WazirX said that it will cooperate with the investigators. Others have volunteered data and have claimed that they were not investigated for money laundering.

But with little to no regulation around crypto, these questions will keep coming up. And until investigators can find the wallet addresses, they won’t stop turning up the heat.

Aave Believes In Pause

The Aave community has sought to suspend Ethereum borrowing until the Merge is complete.

FYI A few Ethereum miners will lose their income source when the blockchain moves to proof-of-stake (PoS). Anyone can become a validator by staking 32 ETH under PoS. But some miners will attempt a hard fork to break away from the Ethereum chain and continue mining under proof-of-work.

Why a pause?

Aave doesn’t like the idea of the risks its community will have to weather. How does it work?

Users may borrow Ethereum before the Merge to gain from the hard fork.

High borrowers could cause liquidity concerns.

A supply-demand mismatch could lead to price fluctuations for staked Ether and Ethereum.

To prevent insolvency, Aave has asked the community to approve an ETH-pause proposal, till the Merge completes on September 6.

Dubai Has Rules To Play

Don’t make promises you can’t keep. That’s the key message from Dubai’s crypto regulator to the virtual asset providers. The Virtual Asset Regulatory Authority (VARA) has instructed crypto firms to not make claims about guaranteed returns.

What does VARA say?

VARA wants to safeguard investor interest. For this, it has asked crypto firms to:

Ensure factual accuracy so that customers do not fall for scams.

Make explicit disclosures about promotional content.

Inform customers about the risks of investments.

These rules will apply to all entities that have received the Minimum Viable Product (MVP) licence. MVPs are products launched in the market with basic features. FTX subsidiary FZE, for instance, holds an MVP licence.

Customer is king

While Dubai doubles down on crypto promotion, the focus is on customer protection. And there are fines if companies don’t stick to the rules.

Musk Wants Backup

Elon Musk backed out of a deal he promised to do. He needs to prove Twitter duped him. And now the free speech absolutist has latched on to whistleblower Peiter Zatko. Musk wants Zatko to be a witness in court.

Why Zatko?

It is pretty straightforward. Musk had said earlier that Twitter misled him, hence he won’t buy the social network. Twitter sued Musk in response. Zatko claimed that Twitter let governments in and let them access privileged data. He’s also backed Musk’s allegations about the bot problem at Twitter.

ICYMI Musk has sent another deal termination letter to Twitter.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.