Where’s all the ETH gone?

In today’s edition, Aussie’s crypto push, BTC=BTC, and time to dump Bored Apes?

Good morning! Welcome to The Daily Moon. Gone in 99 seconds. Web3 game Splinterlands sold out its newest NFT card game for $5 million in less than two minutes. This was just the presale of the play-to-earn game. Did anyone say bear market?

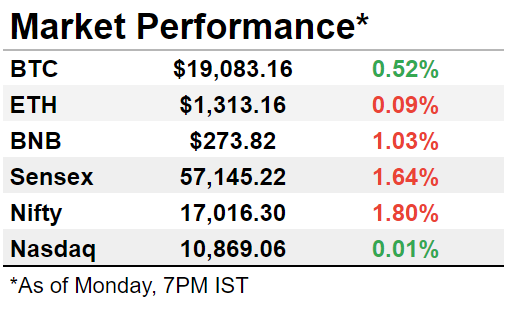

The markets showed a mixed trend. Bitcoin was a little above $19,000 while Ethereum was at $1,310 levels. Nasdaq was flat in early trade. Back home, Sensex and Nifty continued their losing streak.

Merge Effect? ETH Is Scarce

Getting hold of Ethereum has gotten tougher after the Merge. Data showed the network added ~7,300 ETH since September 15. If it stuck to proof-of-work, ~128,000 would have been added. No immediate benefit for Ethereum prices, though.

What’s changed?

Ethereum’s move to proof-of-stake may have led to the fall. But that’s not the only reason. Experts said that the network activity has dropped since the PoS shift, simply because miners moved out.

About ~16,000 Ethereum tokens, worth ~$20 million, have been dumped by miners. There is another 245,000 ETH in crypto rewards left on the blockchain.

But there’s some good news. A fall in network activity means that transaction costs will decrease, too. The costs on this blockchain have hit a two-year low. OpenSea, which consumed a big chunk of the gas fee, has cooled off.

Who wins? Users and decentralised applications.

FYI: Total transactions on Ethereum have gone up 20% over the past two years.

Start of a bull rally?

No signs yet. The number of tokens issued is still higher than the number burnt. Around 519 ETH are burnt as against 772 ETH issued daily.

Another altcoin faces a similar fate. Cardano, which was upgraded after the Vasil hard fork, has started to slide. Volumes have crashed and so have active addresses.

The Aussie Crypto Ride

The weather is always the other way around in Australia. It seems to match up with crypto too. According to a survey, 1 million Aussies will buy cryptocurrency over the next 12 months. Australian crypto ownership has grown 4% year on year, reaching 21% in 2022. The report found that another 1 million new Australian crypto owners are likely to emerge in 2023.

What’s driving this?

Interest from millennials, Gen Z, Aussie parents, and those in full-time work, according to the survey. So much so that a senior official at Swyftx expects “half of the adults under 50 in Australia to own or have owned crypto” in the next two years.

Positive Aussie focus on crypto

As we’ve said before, Australia is doing some very interesting things with crypto regulation. There is also mainstream acceptance driven by sports sponsorships. Unlike most major countries, Australia is neither shutting down crypto nor suspecting the tech just because it's new. Progressive, we say.

Bitcoin Is Unlike Anything

Not an inflation buffer or gold replacement. Bitcoin’s much more. That's the new narrative. So much so that crypto investors want to measure BTC’s value against, erm, itself.

This sounds complicated

Let us first understand how cash works. If you take the US dollar, its price fluctuates because of an unstable supply. So when there is an excess cash supply in a slow economy, a price rise or inflation happens. Bitcoin won’t have this problem since there’ll only be 21 million BTC ever mined.

To simplify, Bitcoiners argue that all that matters is that 1 BTC equals 1 BTC. Meaning this crypto won’t face the economic challenges of government-backed currency.

But what about USD?

So far, Bitcoin’s price is calculated against the US dollar. The idea is to not fret over the token’s performance versus the US dollar. What will be crucial in the long run is how many Bitcoins you own. Whatever helps them sleep at night.

Let The Bored Apes Go

It’s been happening for a while now. The buzz around NFTs has been falling, and their utility has been questioned. Now there’s an argument that the Bored Ape Yacht Club, one of the most popular NFT collections, is actually causing more harm to the wider adoption of NFTs.

Why?

Because they’re the “face of the NFT hype cycle”. Falling prices are just one indication they’re not as popular. Sure, NFTs like Bored Apes and Crypto Punks made them a buzzword, but now this popularity is actually clouding the other applications NFTs can actually serve. For someone looking to understand NFTs, they’re just unreasonably overpriced pictures.

Wait, NFTs are more than that?

Yes, they are. The technology behind NFTs can have real-world applications like carrying medical data. Or serving legal documents. Or streamlining royalty payments. But when you think of just Bored Apes, it clouds your judgement. This is also why there is already a move away from calling them NFTs to saying digital collectibles.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? This newsletter’s ambition is to educate (and to entertain). The world of money is changing everyday and we want to help you decode what’s happening in the world of crypto, public markets in the US and India.