What caused the wipeout?

In today’s edition, what is the real use case for NFTs, asset manager strategy and BTC <$1?

Good morning! Welcome to The Daily Moon. We’re getting closer to the Merge. The stage is being set. Quite literally. The ConsenSys-built Ethereum 2.0 client Teku tweeted Monday about the release of a new update that marks the first step towards preparing for D-Day. All users have to upgrade before September 6, and be ready for the final Merge event on September 15. This just got real, guys!

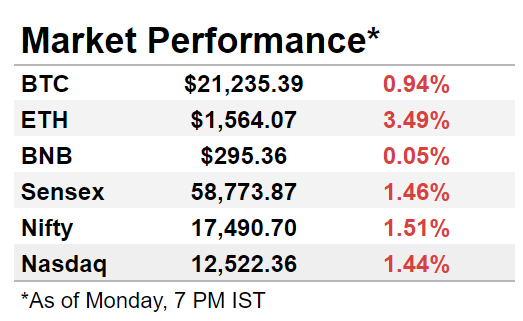

The markets were down on Monday. Bitcoin continued to be around ~$21,000 levels, while Ethereum ~$1,560. Nasdaq fell 1.44% in early trade. Back home, worries over a global slowdown dragged the markets down.

Breaking Down the Crypto Wipeout

Over the weekend, Bitcoin lost ~9% of its price, Ether lost ~10% of its price. The slide was fast and brutal. And as it happens, people asked: where is Bitcoin and Ether’s real bottom? The sceptics said it will keep finding new lows, the cheerleaders said these assets are here to stay.

The why

There seems to be no real reason why this correction may be taking place. But the larger trends indicate that it is the Fed. With a reduction in fuel prices, there was an understanding that inflation will correct as well. But notes from a recent meeting state that the US Fed will raise interest rates once again. The question is now: how much? Outside of the US, the economic conditions point to an inflation crisis that is just getting started. In the UK, inflation is at record highs and in Germany the producer prices went up by 37.2%. High inflation = lower spending power.

A lone warrior?

Ripple's XRP, however, broke rank and file. The messaging was that the company’s executives met lawmakers in Japan and there may be something cooking there. The network recorded its highest number of large transactions in three months recently. The reason for this spurt is as yet unknown.

A Gaming Use Case For NFTs?

This is a conversation that has been had before. What is the real use case of NFTs? Beyond owning a JPEG. The questionable nudge has been that it supports smaller artists and it helps art reach a larger audience. But the reason investors collect art is not solely for the joy of owning it but also for the value locked in it. That down the line, there will be a buyer and the price will appreciate. This has been applied to gaming as well.

What’s in a name

This column on Gizmodo explains how NFTs, in a different form, always existed and can never scale. Let’s break it down.

Most games now allow users to buy cosmetic additions to their avatars. These cosmetic additions have to be purchased by using cash.

Now, these cosmetic additions can be sold or traded but there is no cash realisation. The sales will help users buy games or more cosmetic additions.

If this asset is trapped within a small ecosystem, there is no way it can be used as an investment.

The only entity that makes money is the gaming company.

The Asset Manager-Crypto Hedge

Last week, we wrote about asset managers taking to crypto and this being a way to the digital asset class finally making it to the mainstream. Analysts say it is smart to look at how and why these asset managers such as BlackRock and Abrdn are in this sector.

Understand then win

The likes of Abrdn, for instance, bought equity in an exchange rather than the token. It is a way of understanding how this market functions. Irrespective of the future, the underlying blockchain technology is here to stay. And that needs to be analysed.

Even a bubble has pros

On the flip side, even if there is little belief in the ecosystem and it’s all a bubble, there is money to be made being on the right side of it rather than missing out on it altogether.

BTC Transaction Fee Now < $1

For the first time in two years, the average transaction fees on Bitcoin blockchain fell to $0.825 on Monday. Low transaction fees have always been held as one of the things that would enable wider adoption of the Bitcoin blockchain as a financial system.

What is driving this?

Many reasons. Timely upgrades, for one. There are also falling market prices and lower mining difficulty. Bitcoin mining difficulty hit an all-time high in May this year, rising again earlier this month. But the falling prices of GPU or graphic cards has meant miners can mine more BTC. All this feeds into the falling transaction costs too. There’s been hopes of cryptocurrency going mainstream for a while now, and these developments only take us one step closer.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.