Walking is not helping crypto

In today’s edition, crypto nudges to move, and what’s up with inflation.

Good morning! Welcome to The Daily Moon. It’s a brand new week. But things aren’t going too well for crypto-astrologist Maren Altman. She did some PR for Celsius on social media but didn’t disclose that it was a paid deal. Now the news is out and her followers aren’t happy. Guess her stars weren’t aligned.

Moving on, today we talk about the move-to-earn crypto apps, and why inflation affects markets.

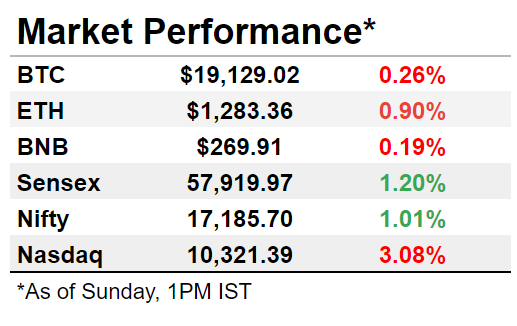

The markets recovered but stayed cautious. Bitcoin was slightly above $19,000 while Ethereum was getting closer to $1,300. Nasdaq fell on an inflation-led selloff. Back home, Sensex and Nifty gained due to a rally in IT and banking stocks.

Photo by Luke Stackpoole on Unsplash

Crypto’s Trying To Get A Move On

Video games always took the blame for sedentary lifestyles. But in 2016, Pokémon Go took the gaming world by storm. The game encouraged players to move outdoors and locate Pokémon. Everyone was hooked. Five years later, crypto tried something similar.

Till 2021, you could earn crypto by either mining or trading. Crypto enthusiasts spent hours hunched in front of their computers trading. And traders became the new couch potatoes. Some crypto developers wanted to change that image.

Enter move-to-earn aka fitness crypto. Here, you get to earn rewards as crypto for working out. Run, jog, cycle. The more you move, the more you earn.

Who started it?

People were tired of the COVID-19 induced lockdowns. But with gyms and fitness centres shut, people needed some motivation to exercise. This was an open opportunity. And right on cue, in November 2021, the NFT game Genopets was launched, which started the shift to move-to-earn. Similar to Pokémons, this game has virtual pets called Genopets. These pets need to be taken out for walks and runs. The higher the activity, the stronger the Genopets become. Users win crypto rewards. The best part? No upfront minting fees.

After Genopets, there came STEPN in December. The premise was the same. Earn crypto rewards when you walk, jog, or run. The only difference is that you need to buy NFT sneakers first.

This genre has expanded since then. There’s beFITTER, dotmoovs, Fitmint, MetaGym, STEP, Sweatcoin, Walken, and Wirtual, among many others.

How does it work?

Crypto fitness games are just like regular video games. Just that you need to exercise to earn rewards. While each M2E game has a different format, the basics are the same. Let us break down the mechanism:

Players download the app and feed in health-related information such as height, weight, and daily fitness goals.

The game app then offers a virtual avatar with accessories (if any) such as sneakers and exercise equipment that have to be purchased.

Trackers on the smartphone monitor the duration of the fitness activity.

If the daily goal is met, rewards are given as in-game tokens.

These tokens can be used for upgrades within the game or to buy accessories.

Players can encash the crypto rewards in the end via exchange wallets.

But most M2E games are not free. You’ll need to pay for rearing virtual avatars, buying exercise equipment, or workout accessories like sneakers.

The market takes notice

These fitness crypto apps have attracted investor interest. Genopets raised $8.3 million in seed funding in October 2021. In January 2022, STEPN received capital worth $5 million in a seed round. Walken raised $4.7 million in June. In July, Samsung Next invested an undisclosed amount in Genopets.

There’s rising user interest. STEPN claims to have 2.3 million active users and had a Q2 profit of $122.5 million. Sweat Economy says it has over 100 million app users. Walken has over 1 million users.

All’s not rosy

STEPN had to pull out from China in July after a regulatory crackdown. Its governance token GMT has crashed 40% since July and the in-game GST token is down ~78%.

Since the reward crypto is not as valuable, players are disinterested. As of October, STEPN had 11,877 daily users. The platform plans to sack 100 employees to tide over the bear market.

The crypto crash hit M2E because the prices of the reward tokens fell. Recovery will happen when players return.

Why Is CPI Impacting the Dollar?

You’ve seen it over the past week. Actually, you’ve seen it this year for months. Every time the Federal Reserve makes a comment on the Consumer Price Index (CPI), the US dollar gets wobbly. That, in turn, has a cascading impact on assets across the world. So we thought this was a good time to look at why CPI matters.

What is it?

The CPI is a broad measure of inflation based on the cost of goods and services in an economy. If inflation is low, a central bank such as Fed may reduce interest rates to encourage people to spend money. If inflation is too high, the Fed may increase rates so consumers are more willing to save.

Why it matters to traders

Traders consider the CPI and core CPI figures (which exclude costs in the energy and food sectors because they’re more volatile). Experts weigh in on what they expect these numbers to be. An average of these estimates makes up market expectations. If the CPI numbers released by the Fed beat these expectations, the US dollar rises against other currencies. The opposite happens if the actual numbers are below market estimates.

As a general principle, higher interest rates can create a reduction in demand for cryptocurrencies such as Bitcoin. Why? Because when prices rise, people prefer to invest in areas that tend to give them better interest incomes. Things such as stocks, real estate, etc. Now, you know what happened over the weekend.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? This newsletter’s ambition is to educate (and to entertain). The world of money is changing everyday and we want to help you decode what’s happening in the world of crypto, public markets in the US and India.