The Merge comes with a tax

In today’s edition, stablecoins have caveats, crypto predictions, and MicroStrategy is sued.

Good morning! Welcome to The Daily Moon. Credit Suisse holds a lot of crypto from its clients. $32 million, to be precise. The Swiss bank made this disclosure for the first time ever, but hasn’t given a breakup of what exactly these digital assets were. Guess the DOGE dream lives on.

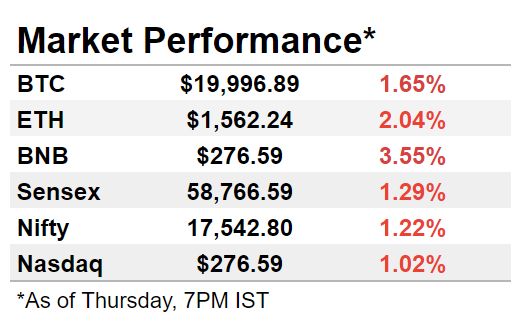

The market was in the red. Bitcoin fell below $20,000 and Ethereum was at ~$1,500 levels. Nasdaq was down in early trade. Back home, Sensex and Nifty fell on weak global cues.

Stable But T&C Apply

Stablecoins are back in favour. Crypto investors have taken time off from Bitcoin to buy these altcoins. There is also a spurt in the prices of tokens such as Lido DAO. Is it time to go all in?

First, the good news

We told you yesterday how investors have moved to stablecoins to seek cover from Bitcoin volatility. That’s how altcoins such as USD Coin and Tether USDT beat Bitcoin in market dominance. Despite a bear market, Lido DAO is the most profitable crypto.

But…

Concerns about stablecoin finances are also back to haunt the market. The world’s largest stablecoin, Tether, insists that reports about its audit delays are “unsubstantiated”. Investors weren’t convinced. Its exchange deposits are now at a three-year low.

Regulators have started to crack down as well. California, for instance, has passed a bill to only allow bank-backed stablecoins.

The European Union plans to ban dollar-pegged stablecoins. Brazil, too, wants to launch a stablecoin backed by its central bank.

Wait and watch

The US plans to hike interest rates till further notice. That means tough times for stablecoin issuers. These tokens are primarily backed by US treasury bonds, so rate increases will cause bond prices to fall. Inflation-control measures could also affect the stablecoin supply since these tokens are linked to the US dollar.

ETH’s Hard Fork Will Hit Hard

The taxman is coming for The Merge. No, really. So, we’ve spoken about The Merge multiple times. But part of this phenomenon is a possible hard fork. One part of the chain will shift to proof of stake, the other will stay on proof of work.

With us so far? Good. Now, if the split succeeds, PoW tokens will be airdropped to miners and ETH holders. How many, we don’t know yet.

Wait, airdrop?

You know what comes next? The taxman. In India, there is a rule that insists that you will have to pay a 30% tax on any airdrop. And the 30% tax is on the value of the token when it lands in your wallet, not when it is realised.

Oh man, more taxes

Experts suggest that you either sell Ethereum PoW after the airdrop or move in advance to an exchange that doesn’t support the token.

All That Glitter, But No Gold

Kathleen Breitman has a list of things in crypto that didn't age well. The Tezos blockchain founder doesn’t mince words. She says it just as it is:

The craze for NFTs: Last year’s 21,000% spike in NFT trading to $17 billion was partly FOMO. Not just VCs, but large institutional investors also jumped in. But unlikely we’ll see another rock JPG being sold for $1 million.

NFT profile pictures: We’ve all seen Twitter profile avatars of cool NFTs. It was cool in the beginning, but the euphoria is pretty much dead by now. The growth wasn’t organic, and there’s only so much hype VC money can buy.

Parts of the Merge: All the focus and excitement around the Merge is on Ethereum moving to proof-of-stake. But it won’t reduce gas fees on the blockchain. More than PoS, its high fee is what has kept people away from Ethereum all this while.

Well, what more can we say?

MicroStrategy Is In Trouble

It’s been a bad year for MicroStrategy. After crypto losses and a CEO change, the business analytics firm now faces a legal battle. Washington DC has sued MicroStrategy and its founder Michael Saylor for tax evasion.

Wait, why?

The government says that Saylor owes $25 million in income taxes. But he and his company filed an incorrect Florida address to avoid taxes.

Saylor claimed he was a Florida resident. MicroStrategy has distanced itself from Saylor’s “individual tax responsibilities”. He stepped down in August after poor earnings. With Bitcoin still in the woods, the world’s largest corporate BTC holder certainly doesn’t need more bad news.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.