Solend survives

In today’s edition, the UK is going pro-privacy, Celsius is MIA, and you can now short BTC.

Welcome to The Daily Moon. Nobody is paying crazy prices for NFTs anymore. OpenSea has seen a 195% drop in trading volume since July 2021. Interestingly, there’s been a rise in users and the number of transactions. Meaning, NFTs are being sold but for cheaper.

The UK Won’t Snoop

The UK doesn’t want to peep into your crypto transactions anymore. The treasury department has decided that it will not investigate unhosted wallet addresses. To simplify, you can receive money even via masked wallets. It’s a stark contrast to what the European Union mandated in March 2022.

Yes to privacy

Europe isn’t in favour of crypto transactions on private wallets that aren’t hosted on exchanges. The EU imposed mandatory KYC on private crypto wallets three months ago. But, the UK is taking a contrarian view. This means:

Crypto senders don’t have to worry about the receiver credentials.

Exchanges won’t be made to verify the identities of each buyer/seller.

Transactions can be quicker.

Information will be sought only if a crypto company is convinced of some suspicious activity. Experts such as Coinbase CEO Brian Armstrong were against compulsory KYC.

EU’s wider lens

The EU is planning a new regulatory regime. Here, a regulated crypto firm in one country would be allowed to operate in other parts of Europe. In related news, the Austrian crypto exchange, Bitpanda, has got approval to offer services in Spain.

China’s stable push?

While we are discussing privacy, China has been trying to push CNH as a stablecoin. It wants the offshore Renminbi to transform into an alternative to the US Dollar-pegged crypto assets. However, experts believe that this may be a pipe dream.

CNH is currently only used in Hong Kong and Singapore in the dim-sum bond market. The dim-sum bond market is valued at ~$82 billion. For context, the market cap of Tether’s USDT token is back to its March peak.

Celsius Is Mum

Celsius needs to act soon. Traders and bankers are frustrated with the lender and want answers. But the company is MIA.

What’s happening?

Once Celsius paused business worth $12 billion, rival Babel followed suit. The latter has reached an agreement to procure funds, but Celsius hasn’t shown its cards yet.

Celsius has discontinued Twitter spaces and Reddit AMAs. And is parroting the same response: recovery will ‘take time’. No explanation for how much time.

Some clarity, please?

Investors are divided on Celsius’s actual condition. The company wants additional time to recover. Meanwhile, five US regulators have begun investigating the lender. The CEL token, meanwhile, is up ~85% and is inching towards a short squeeze.

Short squeeze: When following a sharp hike in token prices, traders who bet on its dipping value buy it so that they can avoid future losses.

Let’s Short BTC

ProShares, the Bitcoin ETF issuer, has launched its Short Bitcoin Strategy ETF (BITI) on the NYSE. Investors can take short-term exposures through their broking account.

Bet and pull

Bitcoin dropped below $20,000 on Saturday. Currently, it’s trading at ~$21,150 levels, but investors are worried. That’s where investing in Bitcoin futures for short periods could come in handy. If your bet plays out, you will make money. In the US, where spot trading on Bitcoin is banned, this is the other alternative to trade.

What about the SEC?

Bitcoin Futures’ products are approved by the US SEC. ProShares’ ETF will be linked to the Chicago Mercantile Exchange Bitcoin Futures Index.

Trading will be live from Tuesday and investors can monitor futures’ prices every day.

Crisis Averted

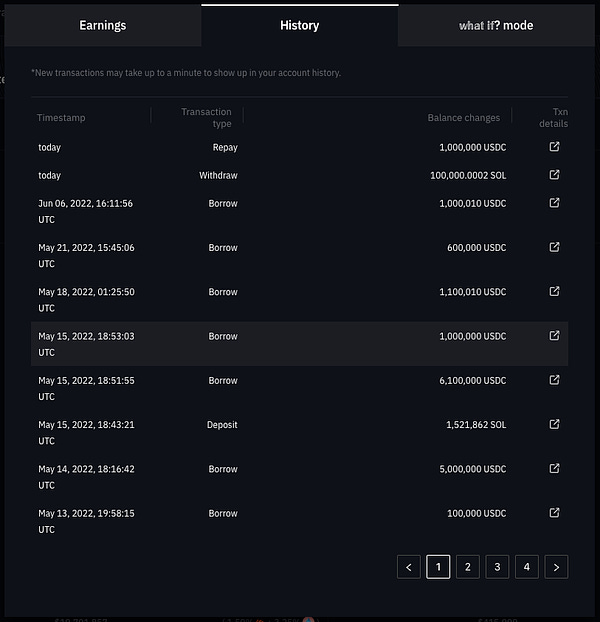

The whale wallet that caused a governance crisis at Solend is moving funds. This means that fears of a big loss are averted, for now.

Getting control

We told you how one large wallet could have liquidated Solana’s DeFi lending protocol, Solend. This wallet deposited 5.7 million SOL, which is worth 95% of the lending platform’s entire SOL pool. If Solana prices crashed, it would have led to a fund crisis. An overzealous proposal to take over this wallet was rejected. Now, this whale is moving out.

With the situation under control, Solana's prices are recovering.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.