Short Tether?

In today’s edition, CoinFLEX is desperate, millennials’ crypto love, and bear-market blues.

Welcome to The Daily Moon. Will he, won’t he? Sam Bankman-Fried may not have decided about buying Robinhood yet. But thanks to the buyout rumours, the Robinhood stock rose 14%. Bankman-Fried claims he is just ‘excited’ about Robinhood, but there are no ‘active’ M&A talks. Sure.

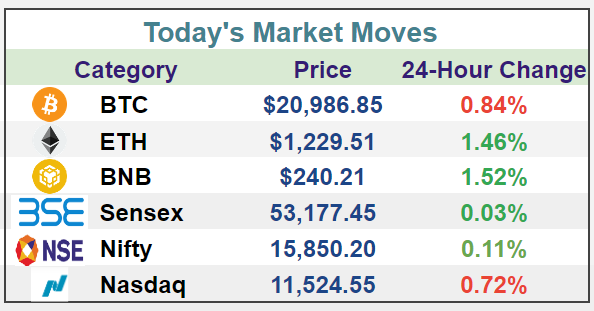

Disclaimer: All price movements are recorded up to 7:00 PM IST

The markets stayed flat, with Bitcoin hovering below $21,000 and Ethereum reporting marginal gains. Technology-heavy Nasdaq witnessed selloff pressures. Back home, Sensex and Nifty saw minor recoveries amidst global markets stabilising.

Plan B Kicks In

The crypto winter spares nobody. But hard-hit crypto lenders Solend and CoinFLEX are now trying ways to recover. Solend got saved from big losses through Binance’s alerts. CoinFLEX is looking to reset by selling bad loans. All this to avoid liquidation.

Whale Attack

Solana lending protocol Solend came close to an enormous crash. A large wallet deposited 5.7 million SOL, which is worth 95% of the lending platform’s entire SOL pool. If Solana's prices crashed, it would have wiped off the network. But Binance spotted this anomaly early on and alerted Solend.

The DeFi protocol has fixed a $50 million borrowing cap per account. This is as the whale account started repaying the loans.

In related news, Solana’s Macaliano brothers are launching their venture capital fund. This will focus on web3, even as the duo switches between building crypto and investing in it.

Slithering out

CoinFLEX is betting on a new token to tide over a client default. It had paused withdrawals citing a fund crunch. Its new plan involves:

Raising $47 million through a new token called Recovery Value USD.

Investors will get 20% interest in buying this token.

FYI: CoinFLEX CEO Mark Lamb clarified Three Arrows Capital isn’t responsible.

A quid pro quo arrangement was in place. The exchange promised to not liquidate the said account if sufficient funds were maintained. But that didn’t happen. For now, the firm is targeting June 30 as the date to restart withdrawals.

Tether Under Attack?

Tether stablecoin is not so stable. It’s under attack once again. In May it experienced selloffs. Now it’s a target of ‘shorting’. Paulo Ardoino, CTO of Tether, thinks American and European hedge funds are ganging up against the stablecoin. He claims that it’s a coordinated attack aiming to ‘harm’ Tether’s liquidity.

Shorting it

Tether’s USDT token is pegged to the US dollar. So, the Fed's ongoing rate hike spree directly affects it. The crypto is trading at $0.99 levels but isn’t immune to the bear market.

Hedge funds want to make money out of this downfall by shorting it. Short selling is when an investor borrows an asset, only to sell it immediately. The idea is to buy for cheap later.

FUD factor

Fear, uncertainty, and doubt are also worrying investors. There's been suspicion around stablecoins ever since the Terra-Luna crash in May. The Fed hikes have added to those woes.

Tether has other concerns too. There are rumours of USDT not being fully backed by the dollar. There are also allegations of exposure to Chinese commercial papers and Evergrande. Tether has denied it all.

Worst Winter Ever

It's official. This is crypto’s worst bear market ever. The tough market conditions, Terra-Luna crash, and volatility have led to a ripple effect. Major crypto assets such as Bitcoin and Ethereum are trending downwards. And there’s no recovery in sight.

All-time lows

Bitcoin and Ethereum are trading below their 200-day moving average. This is a bad sign because investors are paying less than average over the past 200 days.

Down ~55% since the beginning of the year, Bitcoin is hovering at $21,000 levels. Ethereum has fallen ~67% since the start of 2022. Spot prices are also trading low, meaning that investors are losing interest.

Pain everywhere

Institutional investors, too, are exiting rapidly. Between June 20-24, crypto products saw record outflows of $423 million.

Market outflows have also triggered job losses, prolonging the crisis. Exchanges such as Gemini, Crypto.com, and Coinbase are cutting the workforce. A default by Three Arrows Capital would worsen the situation.

Amidst this slowdown, Crypto.com has removed Shiba Inu, Dogecoin, and a few others from its reward program.

Crypto>Mutual Funds

Millennials are partial to crypto. A new report said that Americans in the 25-40 age group are investing in crypto rather than mutual funds. While there is short-term volatility across assets, this group wants to target diversification.

Alt investments grow

Close to 40% of survey respondents invested in crypto. A similar proportion owned stocks. But, less than 38% owned mutual funds. The hunt is now for alternative investments that reward long-term investors. Interestingly, these investors know crypto can be risky but claim that it would help reach their financial goals.

Retirement’s a hit too

Crypto is not just being used for building wealth. Retirement is also on millennials’ minds. These digital assets are being used to accumulate funds for life post 60.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.