SEC is coming for your games

In today’s edition, decoding liquid staking, troubled crypto investors, and Terra is back?

Good morning! Welcome to The Daily Moon. If you thought SPACs were dead, nope, they’re not. Just like zombies, until you shoot them in the head, they will keep coming at you. Bitcoin depot, a digital asset ATM, has struck an $885 million SPAC deal.

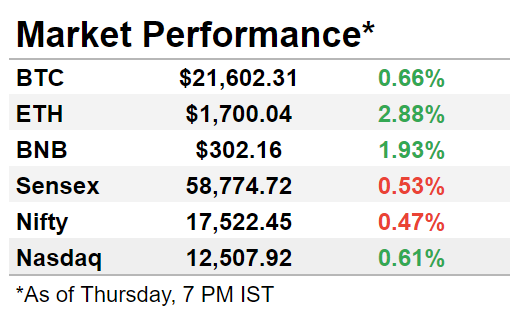

The markets were in the green. Bitcoin continued to trade at ~$21,000, while Ethereum was at slightly above the $1,700 mark. Nasdaq was up in early trade. Back home, Sensex and Nifty reversed their gains amidst global volatility.

GameFi Is Off Safety Zone

After crypto, the US regulators plan to target your gaming tokens. US legislators could launch a crackdown on GameFi or tokens linked to crypto games. Nobody is off the hook. This is amidst Axie’s Phase 3 transition of its game Axie Origin.

What’s the trigger?

A few things. For one, crypto casinos have been masquerading as games and are leveraging creators to hawk them as such. It has created significant outrage and there have been calls to regulate it.

But that’s not all. There is also income that is being generated through games, which governments have little control over. The play-to-earn industry is worth ~$7.3 billion since gamers pumped funds en masse.

So now what?

The US government won’t be banning anything. It plans to find ways to have oversight. Clues on how they will do it lie in the past. Not too long ago, nine tokens listed on Coinbase were declared “securities” by the US SEC. Something similar could happen to GameFi tokens.

GameFi debuts, such as Axie Origin Season 0, are going to be monitored.

What else?

Initial Coin Offerings may face the same scrutiny as IPOs.

GameFi developers may face heavy penalties for non-disclosures of primary investor details.

ETH On A Liquid Diet

The Bellatrix upgrade leading up to the Ethereum Merge is scheduled for September 6. The shift to proof-of-stake has everyone excited. But ICYMI, you won’t be able to withdraw staked ETH immediately after the Merge. It could remain locked for up to a year. Where does that leave us? Enter liquid staking.

Let’s break this down

Liquid staking has been around for a while. The reason it is popular is that it frees staked cryptocurrencies from lockup periods.

Liquid staking lets users earn a yield on those locked assets through an equivalent number of new tokens.

Users deposit their funds in an escrow account and receive a tokenized version of their funds.

It works for other proof-of-stake cryptos too. Lido, Stride, and now Coinbase offer liquid staking.

What is the benefit?

Once Ethereum moves to a proof-of-stake model, liquid staking could become one way for people to earn a passive income from their staked assets.

Crypto Traders Want Clues

Crypto traders want answers. Or at least some indication of where the interest rates are headed. With no signs of a fall in inflation, investors await positive cues from the US Fed.

It’s a bad scene

Bitcoin fell ~53% and Ethereum is down ~55% since January. Information from the July policy meeting showed that the Fed expects more rate hikes.

Bond prices fall when interest rates go up. We’ve seen how Bitcoin is closer to bonds than ever before.

There’s the R scare

Multiple rate hikes could push the US economy towards recession. Interest rates went up by 0.75% in July. A recession situation would impact crypto prices since investors may not have enough capital to trade. Only the Fed's reassurance about rate stability could offer some solace.

Terra Has A Mysterious Bull

Do Kwon’s crypto twins are in a bull market. Terra Classic and Terra ClassicUSD rose ~13.5% and ~31% since August 24. What puzzled investors is the absence of any trigger for the upside.

What’s the secret?

Volumes of the “classic” Terra tokens have spiked. Before you get too excited, here’s the truth: There’s a pump cycle underway. The Terra-Luna community LUNCDAO (lol, we know) claimed that it controls Terra Classic’s price by pump signals.

That’s not all. There is a 77% increase in the burn rate of Terra Classic, so prices go up. No mystery, after all.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.