RIP crypto mining

In today’s edition, miners are turning off the lights, and has BlockFi found a buyer?

Welcome to The Daily Moon. It’s a brand new week. And VanEck is trying again. Eight months after the SEC rejected its spot Bitcoin ETF application, VanEck is giving it another try. An exact same request by Grayscale was rejected last week. Guess a little optimism never hurts.

Moving on, today we talk about why crypto mining is facing dark clouds and FTX is closing a deal.

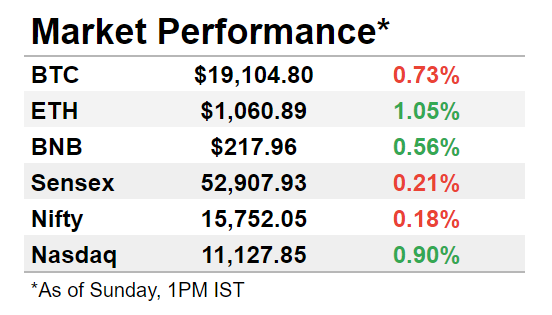

The markets stayed flat, with Bitcoin slipping below $19,200 and Ethereum seeing marginal gains. Technology-heavy Nasdaq saw minor recoveries on a slight reduction in sell-off pressures. Back home, Sensex and Nifty ended on a weak note amidst weak global sentiments.

Image by WorldSpectrum from Pixabay

Crypto mining’s treacherous road ahead

Bitcoin miners generated $15.3 billion in revenue in 2021. This was a 206% increase over the previous year. It looked like crypto-mining could become an alternate source of income for many dabbling in the space. But a year later, the large mining rigs are quiet. Miners are dealing with debt, falling crypto prices, and regulatory tightening.

The 140-character explanation is that because energy prices have gone up and crypto prices have gone down, which means costs> income.

But there’s more nuance to it. We’re seeing a perfect storm of rising costs, inflation, and recessionary headwinds. Currently, large crypto companies are struggling to stay afloat.

Why was mining popular?

The pandemic led to job losses and pay cuts. Work-from-home was the new normal. Amidst this, crypto prices started to rise. Bitcoin peaked at $64,000 in April 2021. For new entrants, this seemed like a good opportunity to enter the pool.

For serious investors, a price spike meant that mining offered a chance to own a large chunk of crypto assets. But there were other factors too:

China crypto ban: In June 2021, China outlawed crypto mining. Bitcoin became 28% less difficult to mine after the hashrate collapsed.

Equipment boom: Crypto market’s highs lead to a mining boom. Miners bought $3 billion worth of mining equipment. Nvidia launched a crypto-focussed GPU.

Wider acceptance: El Salvador made a bitcoin legal tender in September. Global behemoths such as PayPal allowed crypto payments.

But by the end of 2021, the situation started to change. ETH had started its move to a proof-of-stake model. This meant that mining Ethereum would no longer require advanced equipment and tonnes of energy, like the BTC.

What happened in 2022?

The current year began on a volatile note. An aggressive Covid variant caused panic across the world. This coincided with Russia planning a mining ban.

On January 21, the cryptocurrency market cap fell by $205 billion within 24 hours. But the bad news didn’t seem to end. Here’s what ensued:

The Russia-Ukraine war brought forth skyrocketing inflation and energy prices. This meant miners had to pay more to stay active. Dipping BTC prices and rising network mining difficulty levels saw their profitability levels fall by 80% since November 2021.

Kazakhstan was touted as the next big mining hub after China. But it slashed its mining power supply since it impeded its domestic energy demands. Meanwhile, New York imposed a two-year ban on any new PoW mining projects.

The Terra-Luna crash wiped off $60 billion of investor money in May. That triggered a chain of crypto companies such as 3AC struggling to stay afloat.

Top miners are stuck with up to $4 billion in loans that they need to repay. The freefall in prices has continued even as energy prices have soared globally. Mining companies are unable to recoup their losses, leading to drastic consequences.

Compass Mining, for instance, lost a mining facility in the United States because it couldn’t pay the power bill. Just for the record, mining a single bitcoin can cost up to $25,000. At current prices, it costs more to mint a coin than to sell it. Miners can see their margin disappear, one Watt at a time.

So what’s the other option?

Relatively unknown destinations are warming up to mining. Uzbekistan is opening its doors to crypto mining, only if mines use solar energy. But it's not taxing the cryptos already mined, so there might be something. Russia, too, has had a change of heart. It is open to exploring mining legislation, as long as these crypto-assets are sold outside the country.

The real impact on miners will be known once Ethereum completely moves to a PoS system.

Help The Daily Moon get better

If you’ve gotten this far into the newsletter, I’d like to talk to you on the phone for 5 minutes. Reply to this email with a few slots, and I’ll send across a $50 gift voucher on Mudrex to everyone who gets on the call. Let’s make The Daily Moon the best newsletter!

FTX Wants BlockFi

Sam Bankman-Fried has decided and wants to buy crypto lender BlockFi. First, his firm FTX offered a revolving credit of $250 million to BlockFi. Now, he has upped the offer to $400 million. FTX has signed a deal with BlockFi that gives it the option to buy the crypto lender for a maximum price of $240 million.

Fire sale ahead?

On June 16, BlockFi announced it liquidated a large client. This was allegedly on the back of Three Arrows Capital’s bankruptcy fears. Following this, BlockFi decided to slash its headcount by 20%.

Soon after, Bankman-Fried pitched in to rescue the crypto loan company by offering emergency funds. Interestingly, the current deal does not specify the minimum purchase price for a possible buyout.

More in queue

If Bankman-Fried is so inclined, there may be a few more coming up. Meanwhile, another crypto firm, Morgan Creek Digital, is making a parallel acquisition attempt. Taking a step further, Canada-based crypto lender Ledn has proposed a buyout with fresh funding.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.