Pay for my mistake, says Crypto.com

In today’s edition, ETH finds takers, Compound faces downtime, and FB eyes your NFTs.

Welcome to The Daily Moon. Engineers at DeFi exchange OptiFi messed up. They were out to update the Solana-based system but accidentally shut down the mainnet. Funds worth over $600,000 are now locked. OptiFi promises to compensate all its users. Lessons in how to lose your customer, right here.

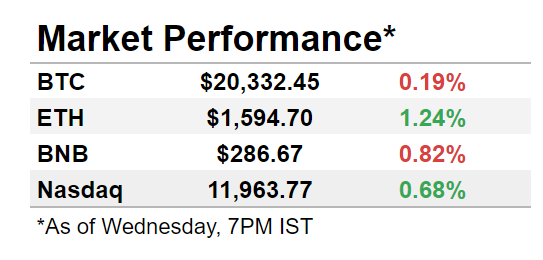

The markets were a mixed bag. Bitcoin was below $20,500 while Ethereum was just off $1,600 levels. Nasdaq rose marginally in early trade. Back home, the Indian markets were shut for Ganesh Chaturthi.

Pump Before The Big Shift

The Merge euphoria is real. We told you about this when the market was depressed, but no one cared. Now, the euphoria is not just restricted to price movements in Ethereum, but has moved on to derivatives as well. Just weeks ahead of Ethereum's PoS shift, there is a spurt in ETH investments. Bitcoin investments, however, are down.

Has it finally happened?

Ethereum’s final PoS shift will begin on September 6 and conclude at the latest by September 20. Before the transition, investors have pumped money into all Ethereum products.

A report from CryptoCompare showed that Ethereum investments rose in August. In contrast, Bitcoin-based products slumped. Here are some key highlights:

Excitement means money is flowing from Bitcoin to ETH. How much money? Difficult to say because, you know, the bear market but large exchanges saw Bitcoin-based products lose cash and are down ~7%. That for Ethereum rose just above 2.3%.

Grayscale’s most notable Bitcoin product, GBTC, saw a 24.4% drop in volume in August. The Ethereum product, GETH, saw a volume growth of 23.2%.

Why did this happen?

There’s Merge, of course. But another factor is traders’ need to diversify their crypto portfolio. So if they are hit with big losses due to Bitcoin volatility, there’s ETH to fall back on.

In fact, apart from Ethereum, there is also a rise in other crypto products. Assets in other altcoin investments rose 12.3% to $1.13 billion.

ICYMI

Ethereum miner balance has touched a four-year high. The total balance stands at 261,848 ETH and is valued at over $415 million. Miners keeping the PoW chain alive would receive airdrops of the forked token.

The hope

There has long been chatter that Ethereum will soon dissociate itself from Bitcoin. And both will not have to be judged as a pair anymore. This seems to be a step in that direction.

My Mistake, You Pay

It could very well be a drama series. Or a comedy. Crypto.com erroneously transferred $10 million to a woman in 2021. She used the money to buy a mansion. Now the exchange has sued her to recover the money.

Sorry, what?

In May 2021, an Australian woman wanted a $10 refund from Crypto.com. But Crypto.com messed up and paid her $10 million instead.

But things get worse

Crypto.com realised the mistake only seven months later during a year-end audit. By then, it was too late. The exchange wanted to freeze the woman’s account, but she had moved the money already. As we said, she bought a mansion. A judge has ordered the woman to sell the house and repay the exchange. We would bet there will be an appeal to that order.

Compound Has A Bug

Compound protocol has been hit by a bug. The DeFi lender faced a code error that led to a temporary freeze on Compound Ether trades. Compound will revert to an old price feed, however, after a seven-day governance process.

FYI Compound Ether or cETH is a token by Compound protocol that offers interest gains through crypto lending. Users get cETH when they deposit Ethereum onto the platform.

What happened?

A bug in the price feed caused the Compound Ether prices to not update. So transactions would not complete. To avoid malpractices, the Compound Ether market had to be frozen.

What’s next?

A new price code proposal will fix the issue. However, the change will take a week to come into effect. Compound clarified that collaterals and funds are not at risk.

FB Wants Your NFTs

The crypto wallet dream failed, and its metaverse plan is bleeding. But Meta hasn’t given up on its crypto ambitions yet. Facebook and Instagram users can now post digital collectibles and NFTs to their social media accounts. It’s literally an Instagram post for your cool NFTs. Third-party wallets will be linked to the social media profile for NFT posts.

Let’s remove the filter

Linking the NFTs to Instagram is the first step in its larger plan. Meta wants to build an NFT marketplace where its users can buy, sell or trade NFTs. So far, this is all free. But our best guess is that if you buy a Bored Ape NFT, your feed will be full of other useless junk you never wanted. Nothing changes then.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.