It’s here. The Merge is here

In today’s edition, Bitcoin’s dance with the bear, Binance-USDC split, and Aussie crypto police.

Good morning! Welcome to The Daily Moon. Binance CEO Changpeng Zhao is Team Musk. Again. Remember how CZ backed Elon Musk’s Twitter bid by offering $500 million? Now he’s lobbying hard to help his buddy prove Twitter has a bot issue. Musk tweeted a screenshot of CZ lookalikes (who he claimed are bots) taking up 90% of his comments section. CZ agrees with Musk. Both claims are without proof. The crypto bros are thick.

The markets cheered the start of the Merge. Bitcoin inched closer to $20,000 while Ethereum was at ~$1,700 levels. Nasdaq was marginally up in early trade. Back home, Sensex and Nifty had flat trades.

Bitcoin Bear Is Not Over

Looks like the Bitcoin bear hug isn’t done yet. Bitcoin slipped below $20,000 after US Fed chief Jerome Powell signalled about more rate hikes. The crypto has fallen to ~$19,800 levels, with more pain in sight.

Where is it going?

Close to $500 million in Bitcoin short positions have piled up. These are crypto investors who will make money if Bitcoin falls. Risks of a short squeeze have risen too.

FYI A short squeeze takes place when traders bet that the price of an asset (such as crypto) will drop, but instead, the price goes up. This leads them to buy more assets to recoup losses. Prices go up in response but crash soon after.

There are fears of extreme volatility, leading to selloffs. The Fear and Greed Index showed a sceptical sentiment among investors.

The Mt.Gox puzzle

Apart from the uncertainty around interest rates, there’s the Mt.Gox as well. Mt.Gox was a crypto exchange that imploded in February 2014 after a ~$500 million Bitcoin theft. Wallets linked to Mt.Gox that lay dormant for years have become active. About 15,000 Bitcoins have been sent to a slew of wallets. We don’t know what’ll be done with these tokens.

The history

It’s been a bad year for Bitcoin. After the Terra-Luna crash, the crypto faced harsh winters. Bitcoin slid below $30,000 and has stayed down. Now, with the bad news from the US Fed, recovery could be further away. Some believe that Bitcoin could crash to $10,000 soon. September will hold the key.

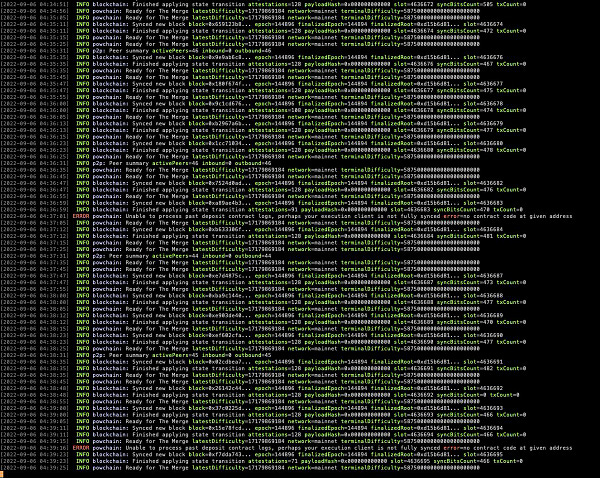

ETH Merge Kicks Off

The Merge is keeping the market on its toes. The Bellatrix hard fork, which is the last major upgrade before Ethereum moves to a proof-of-stake model, took place yesterday. And it has set the stage for the Merge.

There’s excitement and there’s caution. But for now, we’re closer to the Merge than ever before.

What’s happening in the ETH world?

Vitalik Buterin, the founder of Ethereum, is launching a book called Proof of Stake.

Ethereum domain names are the top traded collection on the NFT marketplace OpenSea. Yes, that OpenSea.

74% of Ethereum nodes were ready for the Merge ahead of the Bellatrix upgrade.

With just a little over a week left for the big day, we’ll keep you updated with all that’s happening here.

Binance Breaks Up With USDC

There’s a big shakeup in the stablecoin market. Binance will drop USD Coin, Pax dollar, and TrueUSD from the exchange. The world’s largest crypto exchange will convert these stablecoin investments to its Binance USD token by the end of the month.

Game on

Binance said that it will auto-convert certain tokens to “enhance liquidity and capital efficiency for users”.

Circle’s USD Coin with $52 billion of market cap was just behind Tether’s (USDT) $68 billion market cap. Binance USD comes third at $19 billion. With USDC bumped off, Binance USD can bridge the gap with Tether. It’s almost a sneaky way to get new investors.

What happens to investors?

Withdrawals don’t get affected. USDC funds will be switched to Binance USD and can be removed whenever needed. Circle hasn’t responded yet. So is Tether next? Binance doesn’t have a clear answer yet. It sounds like the company doesn’t like competition. Maybe CZ should talk to his buddy, Elon Musk, to learn how to outdo the competition.

Crypto Guardians Of Australia

Remember when we told you about the cool things Australia is planning around crypto regulation? Well, they’re doing cooler things about tracking money laundering through crypto. The Australian Police have set up a unit to focus on the use of cryptocurrency for money laundering and offshoring.

Why this idea?

Money. This idea came about in 2020 when the police seized assets from various criminals. The seizure broke records and the cops beat their own target of $600 million by two years. Some assets seized were in crypto.

Why does it matter?

Because it is progressive. Countries such as the US and Singapore have taken an extreme view of crypto trading. Case in point: the Tornado Cash ban and Singapore trying to make it harder for people to trade crypto. India, too, is trying to come to terms with crypto trading and money laundering.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.

I also recommend to check $CRP Crypton privacy coin from the UtopiaP2P project and you'll how worth it. It gains in rate every day amd has own no KYC decentralized exchange https://crp.is/exchange/crp_usdt I'm sure that in this year it'll gain more success