It’s ETH time

In today’s edition, SBF needs to pay Voyager, infant crypto attracts capital, and markets are relieved.

Welcome to The Daily Moon. Crypto is hitting Broadway. Web3 marketing firm Serotonin’s CEO Amanda Cassatt is producing Crypto: The Musical. The musical will feature the trials and tribulations of protagonist Zoe’s life, as she quits her corporate job to join a crypto startup. Cassatt has set up MusicalDAO to raise funds for this project.

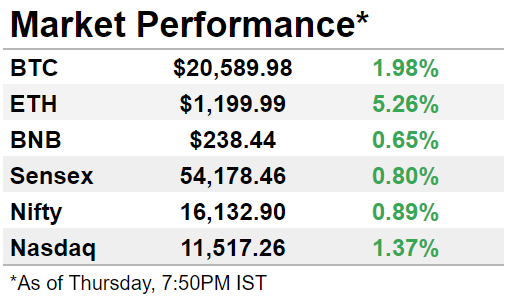

It was another good day for the markets, with Bitcoin holding on to its $20,000 levels and Ethereum edging close to $1,200. Nasdaq posted gains on a marginal recovery in technology stocks. Back home, the Sensex and Nifty stayed stable on the back of Fed’s rate-hike outlook.

ETH’s Big Moment

The real merge is just months away. Ethereum, which has seen price volatility since January, could experience recovery after moving to proof-of-stake (PoS). As part of the Merge, ETH test network Sepolia transitioned to a consensus layer. Here, the devices within the network act in harmony with each other. Ethereum prices jumped 5% soon after. The crypto asset is just one test away from a complete switch to the PoS model.

Will there be stability?

A lot is working well for Ethereum right now. The final merge is now expected to be complete by 2022 end. The network saw a record dip in its high gas costs. The fee fell to $1.57 from about $4-5 per transaction.

With Merge nearing, domain name registrations on Ethereum jumped 216% since last week. Around 108,000 names made their way to the Ethereum Naming Service.

Who benefits?

A move from proof-of-work (PoW) to PoS is a win-win. The power consumption for mining will drop by ~99.95% post the merger. Ethereum mining currently consumes 26 TWh of electricity per year.

Simultaneously, there will be a rise in speed from the current ~30 transactions per second to up to 100,000 transactions per second. For now, the market expects a positive turnaround for Ethereum from the PoS move.

FYI: PoW is where high-power computers are used to solve complex maths problems to mine crypto. In PoS, there is ‘staking’ or putting some crypto to validate a transaction.

In related news…

Meme crypto Shiba Inu is launching a stablecoin. Called SHI, the decentralised crypto will make its debut by December 2022.

Sam Owes Voyager

Sam Bankman-Fried’s Alameda Research was a creditor and shareholder in Voyager Digital. Turns out, Alameda is also a borrower. Alameda owes $377 million to the now-bankrupt crypto lender Voyager.

What about the bailout?

Three Arrows Capital (3AC) was unable to repay debt of $654 million. After 3AC collapsed, Voyager took a $500 million loan from Alameda.

But before this, Alameda had taken a $377 million loan from the crypto lender at a 1-11.5% interest. So, Alameda is Voyager’s second-largest loanee after 3AC. What’s intriguing is that Bankman-Fried wants to be the white knight of ailing crypto companies. He even claims to have “a few billions” to rescue the failures.

Meanwhile at 3AC

Another crypto firm has fallen victim to 3AC. Genesis Trading has confirmed that it has exposure in insolvent 3AC. The crypto broker is now working on recovering potential losses. The exact financial loss hasn’t yet been disclosed.

Stage 1 Crypto’s Rising

Funding is drying up for startups. Bloated valuations and unsustainable business models are driving away investors. Not for early-stage ventures, though. VCs and niche investors are keen to fund debut projects in crypto and web3. Even Binance-backed Mask Network is interested in backing new web3 startups.

What’s so unique?

The recent crypto and web3 entrants have learnt from their predecessors’ mistakes. Valuations are getting more reasonable, even as the use-cases move beyond digital payments. Finance talent from bigwigs such as JP Morgan is also moving to crypto.

While the bear market continues, early-stage funding hasn’t been impacted. Indian web3 startups raised more than $1 billion via 43 deals till June 2022. This has already outpaced 2021, where they gained just $536 million.

Who are the backers?

VCs are looking to deploy their funds on the next unique idea. Europe’s XAnge has closed a $220 million fund to back seed and early-stage DeFi projects, among others. A16z Crypto’s $4.6 billion fund will pump seed capital into web3 firms. Binance Labs has earmarked $500 million for maiden web3, blockchain ventures. Back home, CoinDCX arm CoinDCX Ventures has plans to invest upto Rs 100 crore in early-stage web3 and blockchain startups.

No Guessing Games

The US Fed has made it clear that the rate hikes are here to stay. The Fed will likely increase interest rates till inflation is under control. For the Indian stock markets, the rate-rise suspense is over. Sensex rose 427 points, while the Nifty rose 143 points to touch ~16,132 levels.

Why is this good news?

While the Fed hiked interest rates by 0.75% in June, the bigger question was how long this will continue. Now, it is certain. Indian stocks have clarity on the direction of interest rates. Taking a cue from the Fed, India’s RBI too is expected to follow a hike pattern.

Rate watchers gain

Sectors such as auto, banking, and metals, which get impacted by a rate surge, also moved to the green on BSE. The exact quantum of hike will be known only after the FOMC Meeting on July 26-27. But, the market knows.

Help The Daily Moon get better

If you’ve gotten this far into the newsletter, I’d like to talk to you on the phone for 5 minutes. Reply to this email with a few slots, and I’ll send across a $50 gift voucher on Mudrex to everyone who gets on the call. Let’s make The Daily Moon the best newsletter!

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.