Grayscale’s getting personal

In today’s edition, Terra’s suspicious crash, 3AC may wind up, and Sensex is bleeding.

Welcome to The Daily Moon. Coinbase may share crypto user data with US immigration authorities. Its analytics programme Coinbase Tracer will reportedly provide location and transaction history to ICE. The crypto exchange denies this, claiming that it’s only sharing public data. So much for assured privacy. There are some things Web3 can’t solve.

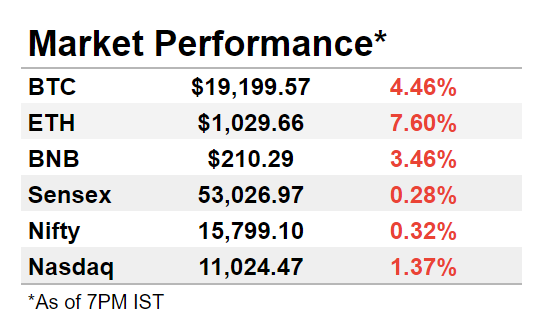

The markets were in deep red, with Bitcoin slipping below $20,000 and Ethereum seeing another day of sharp slides. Technology-heavy Nasdaq fell on reports of falling consumer demand. Back home, Sensex and Nifty also ended on a weak note amidst FPI exits and rupee depreciation.

A Planned Demise?

Was the crash of Terra-Luna an inside job? A new report alleges that Terraform Labs orchestrated the collapse. This investigation states that the parent company engaged in price manipulation using $3.6 billion in stablecoins. A mass selloff in May led to the freefall of TerraUSD and Luna prices.

Was there fraud?

Researchers claim that the crash was manufactured internally. This was the alleged modus operandi:

Through Wallet A, 3 billion TerraUSD was converted into another crypto: Magic Internet Money (MIM) and Tether’s USD Token.

A distribution wallet, also A, transferred 2.36 billion USD Token to this interchanged wallet A.

Another wallet called the Exchange wallet A received 1 billion USD Token from Interchange wallet A.

TerraUSD was a stablecoin, meaning that it would always be equal to $1. But it got de-pegged when the crypto was mass dumped. Sister token Luna suffered too. Initially, Terraform’s CEO Do Kwon had said that they had funds to handle a de-peg. But, the investigation alleges that these crypto wallets’ funds and usage details were unclear.

Not adding up?

The report also claims that Terraform Labs and Luna Foundation Guard had transferred $7.4 billion in tokens to two Binance wallets.

Meanwhile, some investors believe Do Kwon was responsible for the crash. Kwon isn’t saying much, except that he’s lost all his wealth because of the crash.

ICYMI Kwon has been summoned by the US SEC on money-laundering charges and in a separate tax-evasion case by the South Korean authorities.

Grayscale vs SEC

This was coming, but now it is official. The SEC rejected Grayscale’s proposal to list a spot Bitcoin ETF. Now, Grayscale is suing the SEC. The company is reportedly “deeply disappointed” by the decision.

Not yet

The securities regulator has largely opposed crypto investments, citing investor protection. Similar bitcoin ETF requests were turned down by the SEC recently.

Grayscale wanted to convert its flagship Bitcoin Trust into a spot ETF. But the SEC felt that the proposal didn’t answer queries about market manipulation. Spot bitcoin ETFs derive value from the current BTC price. Globally, only Canada and Brazil have allowed them to function.

The big fight

The SEC is at the end of a few crypto lawsuits. Ripple is fighting the regulator in court over its XRP token being classified under securities.

But elsewhere…

While the US remains sceptical about spot Bitcoin ETFs, Europe isn’t overly concerned. Jacob Asset Management is launching the first spot bitcoin ETF. This will be the largest in the world.

3AC Is Contagious

Another crypto lender is suffering thanks to Three Arrows Capital (3AC). Genesis Trading is facing “millions of dollars” in losses after 3AC collapsed. Meanwhile, 3AC’s days could be numbered with a British Virgin Islands court ordering its liquidation.

End-game nearing?

Genesis had said earlier that a ‘counterparty’ failed to meet payment obligations. This was following crypto fund 3AC’s fall after the Luna crash. The crypto fund:

Defaulted on all its repayment deadlines after the Terra-Luna crash.

Lost $200 million that it had invested in Luna tokens.

Couldn’t meet margin requirements on loans from BitMEX, FTX, and others.

Closing in

Crypto broker Voyager Digital, which is owed money by 3AC, is ready to sue. That’s why a liquidation order has been handed in. Additionally, regulators in Singapore have rebuked 3AC for providing incomplete and misleading information. No formal bailout plan has been disclosed yet.

June’s Big Whack

In just 30 days, listed companies on BSE lost Rs 13 lakh crore. Sensex, which is on a gradual slide, fell ~5% in June alone. The index also hit a 52-week low of 50,921 in June.

An FII effect

Sensex and Nifty had their most-volatile session in June, hitting a two-year low. Both the indices were down ~5% during this period. Foreign institutional investors exiting the Indian markets are to blame for the downturn.

More than 30 BSE stocks have touched 52-week lows. There are added worries with the Indian rupee falling to an all-time low of Rs 79.03 against the US dollar.

When will it recover?

The auto sector could experience revival during festive sales, with a slew of new launches. However, experts believe IT stocks could see recovery only by December.

Help The Daily Moon get better

If you’ve gotten this far into the newsletter, I’d like to talk to you on the phone for 5 minutes. Reply to this email with a few slots, and I’ll send across a $50 gift voucher on Mudrex to everyone who gets on the call. Let’s make The Daily Moon the best newsletter!

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.