Gari is down

In today’s edition, crypto firms’ survival worries, BTC’s new disturbances, and India’s crypto tax troubles.

Welcome to The Daily Moon. Three Arrows Capital founders, Su Zhu and Kyle Davies, have gone AWOL. Lawyers handling the liquidation of the crypto hedge fund want an emergency hearing. What’s more intriguing is that Zhu and Davies went on an initial Zoom call during negotiations, but with their audio-video switched off.

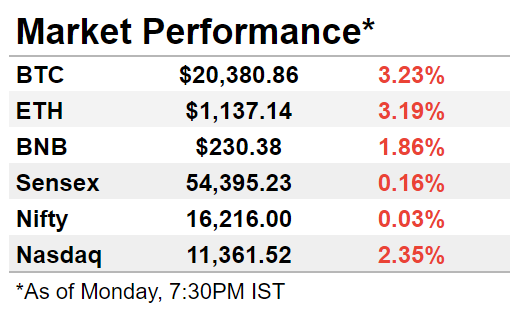

The markets stayed in the red, with Bitcoin slipping and Ethereum sliding well below $1,200. Nasdaq faced selloff pressures and lost its gains. Back home, Sensex and Nifty faced a continued impact of FPI exits.

Fight To Stay Alive

Crypto companies have more than the bear market to handle. CoinFLEX is trying to resolve a payment dispute while Celsius is struggling to recover losses. Meanwhile, the play-to-earn game Axie Infinity is “healing” from a downturn.

Won't give up

CoinFlex froze withdrawals on June 24 following a liquidity crisis. The crypto trading platform later blamed “Bitcoin Jesus” Roger Van for defaulting on loans worth $47 million. Now the company is entering arbitration against Van from Hong Kong. He refutes all claims.

The platform’s native token FLEX Coin is bearing the brunt of the fund crunch. Trading at ~$0.25 levels, it has slipped ~9.2% in 24 hours.

Talking of disputes, the fight for 1.7 million locked Celsius users continues to another day. The company has now hired Kirkland & Ellis LLP to help with restructuring.

Welcome to Polygon

Close to 48 projects, which were originally built on Terra, will now migrate to the Polygon blockchain. The list has names like NFT marketplace OnePlanet and Derby stars, a metaverse-based game.

Polygon is popular because of its low gas fees of $0.0025 and the speed of 7,000 transactions per second.

While we are at NFTs

Axie Infinity saw a steep 205% rise in its NFT sales last week. Launched on July 4, its staking feature allows Axie land owners to earn rewards in AXS tokens.

To date, it has earned $1.3 million. While NFT sales hit a 12-month low last month, Axie is bouncing back.

ICYMI

ING has sold its crypto settlement and custody platform Pyctor to the technology trading platform GMEX. Even post sale, Pyctor will continue to collaborate with the Dutch bank’s digital assets team.

BTC’s New Shocks?

Bitcoin prices may face new shocks. The 2014 Mt.Gox rubble is finally clearing up. The lost capital will flood back into the market. Essentially, Bitcoin worth ~$3 billion will be back in the market. This will create a domino effect, not unlike a large whale dumping its entire portfolio overnight.

How will it flow?

In August, 137,000 BTCs will be released into the crypto network. This is disastrous for the already crashing crypto market, which has fallen below $1 trillion.

The hash rate of Bitcoin has already fallen to a new low, because of declining prices. Coinwarz's data showed that Bitcoin’s hash rate slipped from 292.02 EH/s on June 8 to ~195 levels on July 11.

FYI hash rate is the computational power required to mine on Bitcoin’s network. 1 EH is 1 quintillion hashes (or calculations) per second.

Buy for long

While Bitcoin prices are trailing, indicators suggest an accumulation phase. There is a perception that the crypto asset is undervalued, making this a good time to enter.

Crypto’s Tax Maze

Navigating the crypto winter is a bigger challenge for Indian investors because of the added taxes. The new tax regulations, effective from July 1, mandate investors to pay a 1% TDS besides the 30% income tax.

How does taxation work?

There are three basic components of the crypto tax regime. There’s a 30% income tax, 1% TDS, and no carrying forward or setting off crypto losses. Unlike equities, the losses you incur on your crypto cannot be offset against other assets.

Let’s break it down:

Say you profit Rs 40,000 from transaction A.

But you make a loss of Rs 20,000 on transaction B.

Your net profit is Rs 20,000, taking into account A and B.

But you have to pay 30% tax on your Rs 40,000 profit.

Taxes won’t be reduced even though you faced Rs 20,000 worth of losses.

Notices fly out

Since there is no formal structure, there is a mismatch between trading values declared by the investor and the I-T department’s calculations. Crypto investors are now receiving tax notices based on details collected from exchanges.

GARI’s Whale Dump

Chingari’s social token GARI crashed ~90% last week. The company blamed a $2 billion crypto dump by a whale. But there are plenty of unanswered questions.

Who crashed GARI?

Chingari was left scrambling after the dump led to GARI prices plummeting. With 112 million downloads, Chingari pays creators rewards in GARI tokens. The token was initially popular because of big names such as Salman Khan backing it. Now its valuation has been almost wiped off.

Reports suggest KuCoin was allegedly behind the whale dump. KuCoin, which is also a Chingari investor, has denied these reports.

What’s next?

Chingari is investigating the dump. Meanwhile, the token supply has also risen from 45 million to 150 million. The platform is calling it a black swan event from which it will recover.

Help The Daily Moon get better

If you’ve gotten this far into the newsletter, I’d like to talk to you on the phone for 5 minutes. Reply to this email with a few slots, and I’ll send across a $50 gift voucher on Mudrex to everyone who gets on the call. Let’s make The Daily Moon the best newsletter!

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.

I like the mudrex because it has given chance to invest fund into crypto as like mutual fund. It's very much beneficial and low risk investment.