Fed hates Bitcoin

In today’s edition, Voyager can do it alone, Tesla’s BTC losses, and Zomato gets a jolt.

Welcome to The Daily Moon. A few years ago, a man threw away a hard disk, as you do. And years later, realised that the hard disk had 8,000 bitcoins. The man was distraught. He has now, nine years later, put together an $11 million business plan, which includes Boston Dynamics’ robot dogs to recover the hard disk. The value of that wallet? $176 million.

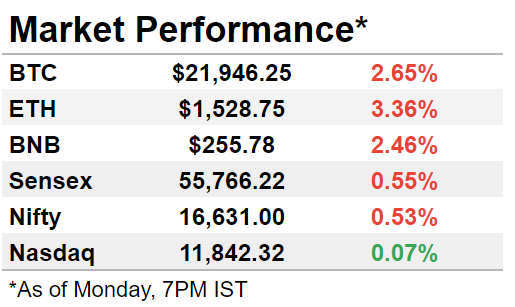

The markets slipped into the red ahead of the rate-hike decision, with Bitcoin below $23,000 and Ethereum losing its gains. Nasdaq was flat amidst volatility in social media stocks. Back home, Sensex and Nifty broke their six-day winning streak on profit booking.

Fed’s Party Pooper Moment

A possible Bitcoin rally could be cut short by a rate hike. The US Fed’s interest rate decision on Wednesday will impact crypto prices. While Bitcoin has not reclaimed the $22,800 average price of 200 weeks, a rate hike could likely increase selloff pressures.

Recession worries

Once considered an inflation hedge, crypto price volatility has mirrored stocks. This means that a rate hike may lead to a Bitcoin sale by investors. The economic slowdown is a real worry, and FUD sentiments indicate fear.

Meanwhile, Bitcoin’s mining difficulty rate has plunged. The easier it is to mine the crypto, the more chance of prices falling.

Volatility begins

Two days before the Fed announcement, Bitcoin prices are volatile. It fell ~3% over the past 24 hours and things remain unpredictable.

And there’s more coming. US gross domestic product numbers will be released on Thursday. Slower growth will spark recession fears. Selling crypto holdings to regain cash could affect prices, too. A 0.75% rate hike is largely expected, but a 1% hike hasn’t been entirely ruled out either.

But there’s some hope in sight. Though short-term prices could be impacted, rate hikes could trigger a higher institutional interest in Bitcoin.

Making a move

Large financial institutions such as Barclays have moved in to make the most of this uncertainty. The multinational bank has bought a stake in crypto firm Copper to make its presence felt in the space.

Voyager Doesn’t Want FTX’s Money

Sam Bankman-Fried has been rejected. Voyager Digital has refused an FTX proposal to buy out the company. The crypto lender, which is on the verge of going belly up, said its leaders could handle the crisis better.

SBF’s acquisition caveats

FTX’s saviour offer involved a purchase of all assets of Voyager, except the loans of Three Arrows Capital (3AC). Customers would get refunds in return for an FTX account.

But Voyager isn’t excited about this plan and calls it predatory. Voyager filed for bankruptcy on July 5 after 3AC defaulted on a $650 million loan.

3AC’s rediscovery

While we are on 3AC, its founders have reappeared. Su Zhu has said the founders received death threats, and that forced them to go underground. Strange.

Tesla’s BTC Losses

Tesla has taken a $170 million hit from Bitcoin. The EV company, which sold 75% of its Bitcoin holdings in Q2, disclosed a $170 million loss from this crypto asset in the January-June period.

Sinking deep

When Bitcoin prices plunged, the EV maker was forced to sell it. In this process, it faced millions in losses. The company gained $64 million post-conversion of Bitcoin into fiat currency. The US accounting rules also complicate matters. Tesla’s Bitcoin holdings are intangible assets, meaning their value cannot be increased. However, if the crypto prices crash, the value is marked down. In effect, Tesla’s stock is impacted by Bitcoin’s fall.

What’s next?

Tesla’s Elon Musk has claimed that the Bitcoin selloff is not a verdict on the crypto. Bitcoin prices have not fully recovered from the crash following the announcement.

Meanwhile

Do you remember Musk’s “joke” tweet, funding secured going private? It seems the SEC has started another inquiry into it. I guess no lols incoming from the regulator. '

Zomato Investors Exit

Investors made a beeline to exit Zomato as soon as the one-year lock-in was over. On Monday, the stock fell 11.4% on the BSE.

Why did the stock slide?

Investors, including promoters and employees, who had bought the stock in July 2021, sold it after the 12-month deadline passed. Almost Rs 89,000 crore of investor wealth was wiped off in minutes because of the share dump. The fall may continue since share sales will happen in phases.

There’s more

Zomato’s shares are also impacted by reports of restaurant exits from the platform due to high commissions. Domino’s Pizza, for instance, plans to pull out business from Zomato if commissions rise further.

Help The Daily Moon get better

If you’ve gotten this far into the newsletter, I’d like to talk to you on the phone for 5 minutes. Reply to this email with a few slots, and I’ll send across a $50 gift voucher on Mudrex to everyone who gets on the call. Let’s make The Daily Moon the best newsletter!

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.

If Zomato would have been merged with Swiggy instead of BlinkIt, the shares would have been something else. That what Ashneer Grover has also told today. I totally agreed with him.