Ethereum is on its own

In today’s edition, Celsius the ponzi scheme, LTC will recover, and Bukele’s big miss.

Good morning! Welcome to The Daily Moon. Elon Musk is getting cornered. Seven more people who lost money by investing in Dogecoin have joined the $258 billion lawsuit filed against Musk. Influencers who backed this meme will be called up as well.

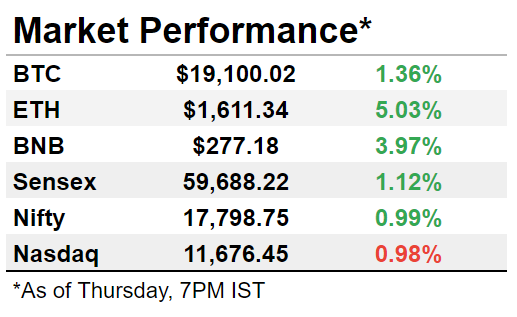

The markets were back in the green territory. Bitcoin crossed $19,000 and Ethereum was above $1,600. Nasdaq fell in early trade. Back home, Sensex and Nifty gained due to buying in IT, banks, and auto.

Was Celsius A Ponzi Scheme?

We knew Celsius was bankrupt. You knew it was bankrupt. Celsius knew it was bankrupt and now the regulators have declared it bankrupt. But that’s not where the story ends.

The Vermont financial regulator has also alleged that Celsius ran something akin to a ponzi scheme. The crypto lender is said to have used new investor funds to pay older ones.

Looks like a duck

Celsius was allegedly aware of its inability to pay yields. But it continued to promise high returns despite inadequate revenue. The Vermont financial regulation department told the bankruptcy court that there was financial mismanagement.

It also said that Celsius CEO Alex Mashinsky made false claims about the company’s financial health. Celsius filed for bankruptcy in July 2022 after the Terra-linked crypto crash. These are the key concerns raised:

Celsius said in a June blog post that it had the reserves to handle the Terra-Luna crash, but it went down just a month later.

Celsius admitted that its financial losses began in 2020. Why wasn’t this disclosed earlier?

The crypto lender bought Celsius tokens in bulk in 2021 and 2022. Were investor deposits used for the purchase?

Walks like a duck

Nobody knows when, and if, the 1.7 million investors will get their money back. Celsius owes $2.8 billion to investors. It plans to utilise future profits of its mining subsidiary, Celsius Mining, to recoup the losses.

Sounds like a duck

Meanwhile, Celsius’ co-founder Daniel Leon has told a US court that his shares in the company are worthless. By now, at least 40 states in the US have begun investigations into the fraud allegations.

Merge Effect: ETH Go Solo

Ethereum’s move to proof-of-stake has more going for the second most traded crypto than just environmental benefits. A new Chainalysis report suggests that post the Merge, ETH may decouple from the price movements of other tokens.

How?

Post the Merge, there will be staking rewards for Ethereum. The more you stake, the higher your return. This will make it akin to bonds or commodities. Until now, only Bitcoin was correlated with stocks, bond markets, and other high-risk investments.

The pool has gotten bigger. For instance, SEBA Bank has launched ETH staking, which will help the crypto delink from the rest.

ICYMI Experts have said they expect staking yields post the Merge to increase 10-15% or even double.

What else changes

The Merge is a rare event. And Chainalysis also expects more institutional adoption of ETH. Driven mainly by the higher staking rewards. It makes sense, given annual returns on US Treasury bonds currently stand at around 3.5%.

LTC Has A Silver Lining

Litecoin is on the same track as Bitcoin. The OG altcoin, “silver to Bitcoin’s gold”, has followed its older sibling’s price chart. Its price is in bear territory. But before you get jittery, things look good overall.

What’s so special?

It is widely accepted and is among the four crypto tokens that can be used on the digital wallet Venmo. It has a slew of new partnerships. Whales have stayed invested in this altcoin. Litecoin has 150 million unique addresses behind Bitcoin and Ethereum. The altcoin claims “Litecoin is to payments what Ethereum is to NFTs”.

But there’s a slight mess

Litecoin’s privacy-focused update Mimblewimble (MWEB) update raised concerns among regulators and exchanges. There’s a fear that anonymous transactions via MWEB will enable money laundering.

El Salvador’s BTC Dream

Most of us heard Nayib Bukele’s Twitter Spaces live a year ago. Bitcoin was made a legal currency in El Salvador on September 7, 2021. A year later, the dream hasn’t been fully realised.

What happened?

El Salvador holds 2,381 Bitcoins worth ~$45 million and is at a loss of $62 million due to the crypto crash. The country’s economy is shaky, with debt expected to rise to 95% of the GDP by 2026.

Some green shoots

Locals believe that banks have cut rates to compete with cheap Bitcoin transactions. Tourism has been boosted too.

ICYMI You can read more about El Salvador’s Bitcoin experiment here.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.