Coinbase’s $1 billion bleed

In today’s edition, there’s hope for Bitcoin, Solana’s DeFi rug pull and the Celsius CEO dumps

Good morning! Welcome to The Daily Moon. FTX is in the news again. This time he’s struck a deal with Reddit to let users pay the gas fee for community tokens in fiat currency. To explain this, have you seen those rewards (you never use) which Reddit keeps prompting you to buy to give to people who have posted something clever, yes, that, well you can pay the transaction fee in your currency of choice. Another day, another use case.

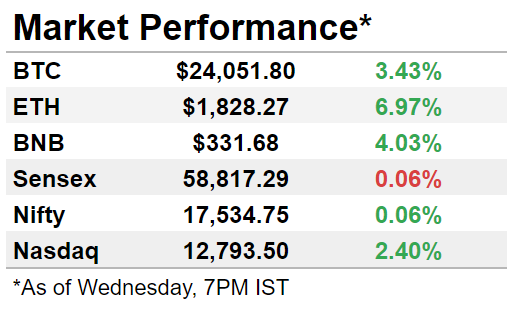

The markets were in the green with Bitcoin recovering to above $24,000 and Ethereum crossing $1,800. Nasdaq was up in early trade. Back home, the Sensex and Nifty ended flat after gains in metal and oil and gas stocks were offset by IT and realty shares.

The Wheat From The Chaff

It’s been a difficult few days if you’re investing in crypto. The prices seem to latch on to a downward trend thanks to indications that the US may release inflation data that will depress the market. But two major financial institutions, JP Morgan and Morgan Staley, seem to believe that despite the fluctuations, crypto, especially Bitcoin, is on a good path.

We’ve found a floor

JP Morgan released a note not too long ago saying that it believed that Bitcoin may have bottomed out. The premier token has lost ~20% of its value in the year so far. But analysts believe that it will not dip any lower than the floor it has found. There are two reasons for it, says a Morgan Stanley report.

The US Federal Reserve is moving towards “expansionary monetary policy”, this is likely to bring optimism.

The contagion caused by Terra’s collapse has been curtailed. All the lenders that were overexposed or had bad fundamentals have faded. The ones that have survived will continue to offer high yields and this time with lessons learnt.

Ethereum’s pending move from proof-of-work to proof-of-stake, i.e., Merge, is also expected to boost Bitcoin and other altcoins.

But what of the meme coins?

The meme coins

They had their moment in 2021. Pumped by the Dogefather and an assortment of Redditors, it made little sense to many people. Some analysts have said its rise (and subsequent fall) is reminiscent of other “worthless financial instruments”. With rising interest rates and a paucity of cheap capital, we will see the eventual demise of these memes coins even if they try to belatedly find a use case.

Coin flip: Coinbase’s Q2 Earnings

Not that Coinbase was having a great year already, but its second quarter earnings result on Tuesday did not do much for investor confidence.

The numbers

Coinbase posted a net loss of $1.1 billion in Q2, from a net profit of $1.6 billion last year. Revenue fell nearly 64% to $808 million. The reasons: economic downturn, macroeconomic factors, pressure on crypto prices, you know this story.

Not the best year

In addition to what it is agreeing is a “tough quarter,” Coinbase hasn’t had the best year so far. It let go of 1,100 employees in June to cut costs, followed by an expansion into India which didn’t quite go according to plan. Then there was an insider trading allegation last month.

But not all is lost. Coinbase is focusing heavily on staking and Web3. It also has partnerships it is banking on, in addition to having cash worth $5.68 billion at the end of Q2, and USDC stablecoins worth $361 million.

Solana’s DeFi Illusion

The DeFi ecosystem being built on the back of Solana was allegedly completely fake. It was two brothers pretending to be 11 developers complete with multiple Twitter accounts that interacted with each other. They weaved a web which ultimately took up a majority of the value of the ecosystem.

How did they do it?

The brothers coded several protocols and linked them together. Now, they found a way to count the capital that flowed through these protocols more than once. This causes the total value locked to increase in a large way. At one point in time, these dollars, which were counted multiple times, accounted for 75% of the value of the Solana DeFi ecosystem, which was at its peak valued at ~$7 billion.

Can this happen again?

Yes, it can. Some protocols will have to strip away the anonymity and pseudonymity. If developers had to declare and verify who they were, these kinds of rug pulls can be prevented.

Can’t stay out of trouble

Bankrupt crypto lender Celsius seems to love controversy. While its clients are still struggling to get back their money, founder and CEO Alex Mashinsky seems to have cashed out some of his CEL token holdings.

Why does it matter?

Because a Twitter-driven #CELShortSqueeze drove up the CEL token’s value higher than it has been since it filed for bankruptcy last month. A Twitter user identified Mashinsky’s wallet dumping CEL on Tuesday.

This isn’t the first time Mashinsky has done questionable things. Just before halting withdrawals for users in June, Celsius reportedly transferred $320 million to FTX. A case of actions speaking louder than words, we say.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.

Rupee add ya widhral kese kre