Circle is not in the circle anymore

In today’s edition, Chainlink’s AWS dreams, Jack’s with Circle, and NFTs collapse.

Good morning! Welcome to The Daily Moon. The UAE doesn’t want you to go to a government office anymore. It is taking its moniker as the web3 capital of the world seriously. Now, you can visit the Emirati economy ministry in the metaverse. Other ministries will switch soon. Grab those VR headsets.

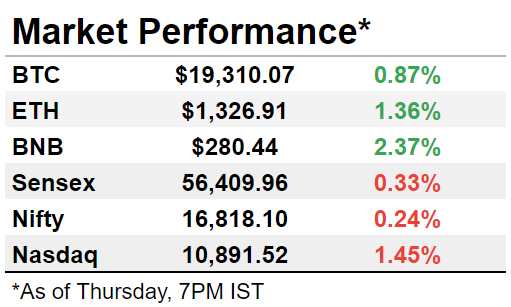

The markets recovered slightly. Bitcoin was at ~$19,300 while Ethereum moved to $1,330 levels. Nasdaq slipped in early trade. Back home, Sensex and Nifty fell ahead of the RBI policy.

Stablecoin Phase 2 Begins

Circle’s USDC won’t be traded on Binance from Thursday. Existing USDC balances will be auto-converted to Binance USD. But Circle’s not a quitter. The stablecoin will be available on five new blockchains to bolster its market share.

Down but not out

USDC has been under the weather ever since Binance decided to dump it. Total volumes are down ~6% because USDC’s been cashed out. USDC outflows on Binance are up 93%. All is not lost yet.

Circle will launch USDC on the interconnected blockchain Cosmos in 2023. USDC will occupy the now-defunct TerraUSD’s position as DeFi collateral on the blockchain.

But there's an EU crackdown

Europe plans to cap daily transactions in non-Euro stablecoins at $200 million. This will mean that USDC and Tether’s USDT usage will be limited in the region. The rules have reintroduced this proposal after a nudge from France.

However, Circle’s not very concerned because it has a stablecoin Euroc, pegged to the Euro.

A hunt for users

Competitors have closed in, so Circle has to look for new platforms to stay relevant. Apart from Cosmos, USDC will be rolled out across blockchains such as Arbitrum, NEAR, Optimism, and Polkadot.

The company now eyes a multichain structure for USDC. Under this plan, USDC will be offered across exchanges, developers, and institutions. It’s being termed the “digital dollar” that will power the crypto economy.

Chainlink’s AWS Dream

Chainlink has taken a step further towards becoming the AWS of the Web3 era. Its staking rewards are set to go live in December. People have been waiting for them for ages.

FYI Chainlink provides real-world data for Web3 apps through oracle networks.

It is kind of like the data infrastructure that many dApps and blockchains need for specific projects.

Getting the right advice

Chainlink made the announcement at its first real-life conference, SmartCon 2022. Among the many interesting people speaking at the event was Eric Schmidt, ex-Google chief, and now an advisor at Chainlink. Along with the staking rewards, it also announced two new programmes—SCALE and BUILD—designed to increase the economic sustainability of its services.

The numbers speak

Chainlink is pretty popular. The number of projects integrating its services at the same time has increased from 1,000 to 1,500 since January.

Dorsey’s New Circle Of Friends

We can’t get enough of Circle. Jack Dorsey’s bitcoin-focused unit teamed up with Circle Internet Finance.

So what’s it about?

Dorsey’s Block has a subsidiary called TBD (yes, we rolled our eyes too), which is focused on bitcoin, and building Web5 (sigh). With this new partnership, TBD and Circle plan to lay the groundwork for making stablecoins more accessible. For whom, you ask? Well, everyone. For people wanting to enter crypto, or for crypto natives to find real-world ways to off-ramp into fiat currencies.

Why do it?

Does boredom qualify? No. Well, he says it is because it is difficult to ignore the fact that people are turning to crypto to protect their hard-earned money from getting devalued. With rising inflation and the larger macroeconomic uncertainty, many currencies have fallen against the US dollar. Argentina and Turkey, for example.

NFTs Hang By A Thread

The NFT mania has faded. Trading volumes for NFTs have crashed 97% across platforms. The crypto winter is partly to blame, but let’s face it. NFTs aren’t as cool as they were during the lockdowns.

A big slide

From $17 billion at the start of 2022, NFT volumes tumbled to $466 million in September. And it is not just OpenSea. There’s just decreased activity across platforms.

GameStop’s NFT marketplace started the business with sales of $1.98 million. It lost steam in only a month, with just $167,000 worth of NFT sales. Ethereum loans with Bored Apes Yacht Club NFTs as collateral could be liquidated too.

Amidst this mayhem, someone paid $4.5 million for a CryptoPunk NFT.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? This newsletter’s ambition is to educate (and to entertain). The world of money is changing everyday and we want to help you decode what’s happening in the world of crypto, public markets in the US and India.