BTC’s on a rollercoaster

In today’s edition, SOLs to shine, Polkadot’s upgrading, and Celsius’ green.

Good morning! Welcome to The Daily Moon. The Deadpool NFT is coming soon. Disney's just waiting for a lawyer to vet it. Disney put out a job offer for a lawyer who could wade through NFT regulations. Or maybe, they’ll launch a Star Wars token. Is DRTHVDR taken?

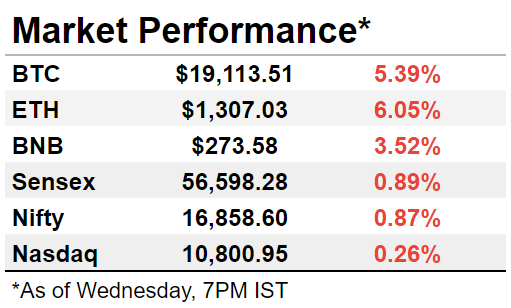

The markets were deep in the red. Bitcoin was at $19,000 levels while Ethereum stuck to ~$1,300. Nasdaq slipped in early trade. Back home, Sensex and Nifty had another day of losses.

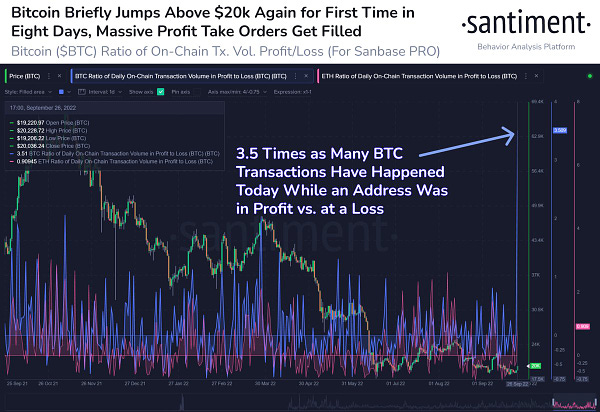

BTC Touched Mount 20K, But..

Bitcoin breached the psychological mark of $20,000 on Tuesday. Amidst recession fears, this was a positive. But the dream of a ‘green’ September was short-lived as the crypto dropped to $18,000 in just a few hours.

What’s up with BTC?

Two words. US Fed. Bitcoin sank last Wednesday, after the 0.75% rate hike by the Federal Reserve. It’s stayed down since then. So when Bitcoin crossed $20,000, it came as a surprise.

But there’s not much to rejoice about. Here’s what happened:

The crypto rose only because short sellers bought more tokens to protect against losses.

When Bitcoin zoomed past $20,000, anxious traders sold the crypto.

This brought Bitcoin back to the $18,000 levels.

Will it be a green October?

Investors have made profits of over $5 million from the fluctuations in Bitcoin’s price. Short-Bitcoin inflows were at an all-time high of $172 million. These funds bet against the price of the crypto. That means investors benefit if Bitcoin falls and lose if it rises.

But Bitcoin has the support of institutional investors. MicroStrategy, for instance, bought another 301 Bitcoins taking the total count to 130,000.

The market is also relieved by the fact that Bitcoin has been less volatile to interest rate movements than before. This comes just in time for the green October season.

The crypto has a track record for an October bull-run since 2014. Bitcoiners are hoping for a repeat this year too.

Solana’s In the Big League

Things are looking up for Solana. It’s the next big destination for NFTs and the blockchain has found more takers. Now, it wants to achieve its dream of being the Ethereum killer.

What’s driving the growth?

Solana crossed the 100 billion transaction mark. Thanks to NFTs and decentralised applications, it even beat Ethereum with a daily transaction count of 40 million.

Since it is cheaper and faster, Solana has become the hub for NFT aficionados. On Monday, the blockchain facilitated sales worth $1.6 million. Ok, nothing fun happened to its token price though. But that’s not the story here.

The real Ethereum killer?

Though it’s more cost efficient than Ethereum, there is a wide gap between the prices of Ethereum and Solana. But Solana believers say that the crypto will cross $370 when it upgrades faster to onboard new businesses.

If you go by what Solana Labs’ CEO Anatoly Yakovenko says, the next Avengers film will have an NFT component. And Solana will be first in queue.

Polkadot On A Bull Sprint

Ethereum done. Cardano done. Now, it’s time for Polkadot. It’s now set to be upgraded as well, which will make the blockchain 10,000-times faster. Investors have loved the idea of this update and the token went up 11%.

What’s the upgrade?

Called v9280, the upgrade will increase Polkadot’s speed. Compared to 1,000 transactions per second, v9280 will enable between 100,000 and 1,000,000 transactions per second. The blockchains within Polkadot, also known as parachains, will also see a 50% reduction in block addition time from the current 12 seconds. To simplify, more bang for the buck.

Will the rally last?

Polkadot is already more popular than Cardano among application developers. The upgrade will increase its use cases. Will it gather enough use cases to become a breakout star? Time will tell.

SBF “Saves” Celsius?

Your Celsius funds are still locked. But Sam-Bankman Fried may buy out the bankrupt crypto lender. This buzz means the Celsius token went up 15%. Co-incidentally, Celsius CEO Alex Mashinsky has quit too.

Another deal?

Well, it isn’t confirmed. A few days ago, Bankman-Fried’s FTX got a go-ahead to buy another bankrupt lender Voyager. This will be the second one in a row.

CEO is sorry

Mashinsky apologised in his resignation letter. He has promised to help investors recover their dues. The saviour of crypto hasn’t said if he will facilitate any recovery of funds.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? This newsletter’s ambition is to educate (and to entertain). The world of money is changing everyday and we want to help you decode what’s happening in the world of crypto, public markets in the US and India.