BTC rewards, please

In today’s edition, Voyager needs lifeboats, crypto gamblers galore, and Russia’s disagreements.

Welcome to The Daily Moon. It’s too hot to mine Bitcoin in Texas. Temperatures have soared above 38 degrees Celsius and are expected to stay high. Miners are halting operations till the power demand subsides in the state. Nasdaq-listed Core Scientific even switched off its ASIC servers till further notice to “give relief” to Texans.

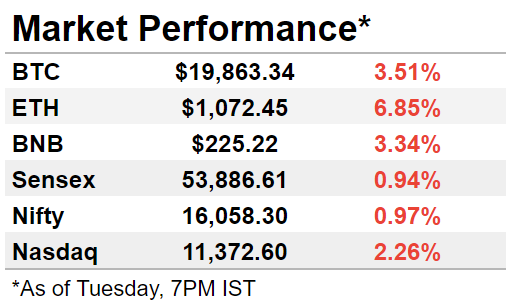

It was another tough day for the markets, with Bitcoin slipping below $20,000 and Ethereum seeing a sharp decline. Awaiting the US inflation data, Nasdaq was in the red. Back home, Sensex and Nifty were flat amidst weak global cues.

The Love For Crypto Cards

Traditional credit cards are being junked for crypto credit cards. Not only are plastic credit users across generations bullish about crypto credit cards, but they also expect a complete takeover.

Swiping for popularity

A survey of credit card users showed that 46% want to use crypto cards for all purchases. A whopping 80% believe that they will efface traditional credit cards over time.

Card companies such as Mastercard and Visa have already made plans to capture market share in this space.

Why crypto cards?

What draws customers to such cards are the crypto rewards. Close to 60% of the survey respondents revealed they wanted purchase rewards in Bitcoin. Ethereum and Litecoin are the next two popular digital assets.

What’s it used for?

Groceries, education, dining, and travel were the four most popular purchases using crypto cards. Staying true to their investing intentions, 60% used their crypto reward balance to buy crypto. Depositing the balance in retirement, savings, and emergency accounts also made it to the list.

Any caveats?

It’s a credit card, after all. So if you don’t repay on time, there’ll be hefty charges. Typically, interest rates range between 33-42% per annum on unpaid dues on credit cards. This risk is all the more heightened in crypto credit cards, where there could be higher fees per transaction. But when the market slides, the rewards may not mean much. Another business model built for the bull.

Voyager: You’re Getting Nothing Back

The woes of crypto lender Voyager aren’t ending soon. First, it suspended all withdrawals and deposits. Then came bankruptcy. Now, Voyager is uncertain about paying back all investors.

Stocking up funds

Voyager’s recovery plan focuses on saving customer assets. Paybacks, if any, will happen in Voyager tokens, other cryptos, and shares. Voyager has $1.3 billion worth of user funds. It also has $650 million worth of defaulted loans owed by the now-bankrupt 3AC.

Any recoveries from the 3AC loan will be used for compensating investors. But that too seems tough, now that 3AC founders have gone AWOL.

They’re wiped out

It’s complicated. While Voyager told customers that government-backed FDIC insures their funds, this isn’t applicable to crypto assets. FDIC clarified that Voyager’s banking partner, Metropolitan Commercial Bank, is insured, not the crypto lender itself.

Crypto Traders=Gamblers?

A study by the Swiss Finance Institute equates crypto traders to gamblers. The study says that crypto investors tend to trade in digital assets and stocks at the same time and in the same direction.

Betting on gains

The insights are from 75,000+ accounts active in Swissquote, a bank that also offers crypto-trading services. Here, 21% of the account holders were dabbling in crypto.

The research finds a strong relationship between stock trading and crypto investments. So much so that the correlation between stocks and crypto reached 60% in 2022 from 0 in 2020.

What’s driving it?

Stock trading soared as casinos and other major gambling avenues were shutting shop due to Covid-19. The study found that crypto traders have a penchant for risk. Naturally, they prefer stocks whose prices mirror cryptos.

On average, the study revealed that crypto-oriented retail investors are poorer, younger, mostly male, more active, and keener on taking risks.

Russia’s Banker Says No?

Just two weeks after Russia’s finance ministry floated a proposal for private stablecoins, the Central Bank of Russia (CBR) rejected it. Lawmakers have called the instruments “assets of higher risk” that have no guarantees.

No consensus

Ivan Chebeskov, the director of the finance ministry’s policy department, had suggested that gold-backed stablecoins could help overcome sanctions. But CBR isn’t convinced. The central bank is wary of private entities floating stablecoins, since the underlying assets are not owned by the issuer. The government-backed digital ruble, which is under works, could be the way forward.

It’s confusing

CBR may legalise crypto mining as long as these assets are sold abroad. But, it’s been unable to form a coherent consolidated statement on how the country views crypto.

Help The Daily Moon get better

If you’ve gotten this far into the newsletter, I’d like to talk to you on the phone for 5 minutes. Reply to this email with a few slots, and I’ll send across a $50 gift voucher on Mudrex to everyone who gets on the call. Let’s make The Daily Moon the best newsletter!

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.