BTC has a use case

In today’s edition, WazirX-Binance faceoff, Dragoma's rug pull, and Morgan Stanley’s crypto love.

Good morning! Welcome to The Daily Moon. Remember how Celsius, which is bankrupt, wanted to hire its former CFO for an eye-watering $92,000 per month salary? The lender has dropped the plan. This decision came just ahead of a Monday court hearing. Coincidence, perhaps?

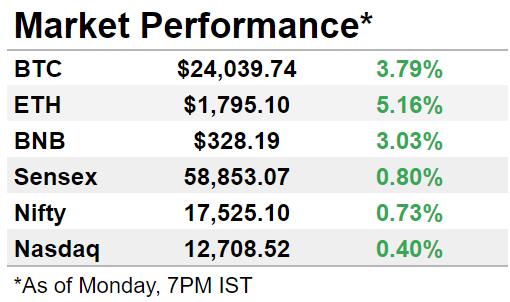

The markets recovered, with Bitcoin above $24,000 and Ethereum at $1,795. Nasdaq was up in early trade. Back home, Sensex and Nifty gained led by the auto sector.

BTC Finds More Use Cases

Ethereum is moving to proof-of-stake, and so are the applications built on it. Bitcoin, however, has built a network of applications on its blockchain. Lightning Network, in particular, has found many takers, with over 100 applications.

What’s the buzz?

It was a common gripe among the believers that Bitcoin did not support developers. High transaction costs and strict network controls were some of the argument points.

But that is changing. Sort of. Through the Bitcoin scaling system Lightning Network, the crypto has seen a growth in users. Digital payments firm Block integrated Lightning into its mobile payments service Cash App. In addition, smart-contract protocols such as Stacks have been built over Bitcoin to implement contracts and develop decentralised applications (dApps) on the network.

There is also competition from within. For instance, a protocol layer Omni built over the Bitcoin network helps developers customise crypto. Some of the use-cases include crypto exchanges, crowd-funding, and token development.

But who leads the charts?

Ethereum’s Layer 2 scaling system, Polygon, tops the list with ~8,000 monthly active developers and ~19,000 decentralised applications. The main Ethereum network has 4,000 active developers, while Bitcoin has ~700.

But, the Bitcoin-based Lightning Network has found prominence. With 4,454 Bitcoin worth $103 million in the network, there’s been a steady growth in Lightning. Exchanges such as Kraken, OKEx, and Okcoin also support Lightning.

WazirX-Binance Standoff

The chaos over WazirX’s ownership has reached its peak. Customers don’t know who owns their exchange. With the lawmaker at its doorstep, WazirX could even drag Binance to court on this matter.

What’s up with them?

This is muddy, so stick with us. Binance said it doesn’t own any equity in WazirX, but the India-based exchange insists it does. Here is when it gets messy. Binance has asked WazirX users to transfer their holdings to Binance.

Curiously, the WazirX-Binance deal was well publicised, including on Binance’s own website. And before the ED came knocking, none of the companies raised objections. Over the weekend, Binance disabled off-chain transfers to WazirX. But then restarted it after the Telegram channels exploded in rage.

Now what?

A few customers panicked and withdrew all their funds. Meanwhile, WazirX’s bank accounts are frozen as part of an investigation.

Dragoma Pulls the Rug

Supporters of Dragoma, a Polygon-based GameFi and SocialFi game, lost about $3.5 million in a rug pull. This comes just a few months after the project was launched.

What happened?

The native token of Dragoma DMA fell 99.7% from its peak value, prompting an alert from security firm PeckShield. The Dragoma website is down (last we checked), and its social media handles have been deleted.

Why you should care

Rug pulls are becoming increasingly common. Of the nearly $8 billion lost in crypto scams globally last year, almost $3 billion was in rug pulls.

They’re popular because they seem legit, and escape scrutiny because of the way they list. Most begin as DeFi projects that get listed on decentralised exchanges without a code audit.

Morgan Stanley Is Into Crypto

Global investment firm Morgan Stanley has set its eyes on crypto. The company will hire a crypto-focussed product manager to launch a range of digital assets.

Crypto calling

With over ~$900 billion in assets, pure-play crypto products were missing from the puzzle. The recruitment drive will enable the addition of active crypto products.

In 2021, it opened access to bitcoin funds, giving indirect exposure to crypto. Since then, the firm has invested over $1.1 billion directly into the crypto ecosystem.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.