Are Matic and BTC twins?

In today’s edition, stable-led recovery, CAKE time, and FTX wins over Voyager.

Good morning! Welcome to The Daily Moon. You know when things are too good to be true? Yes, a few US states have said Nexo’s promise of returns fits in that bucket. The lender offers a staggering 36% interest on crypto deposits. Nexo is being forced to change its pitch.

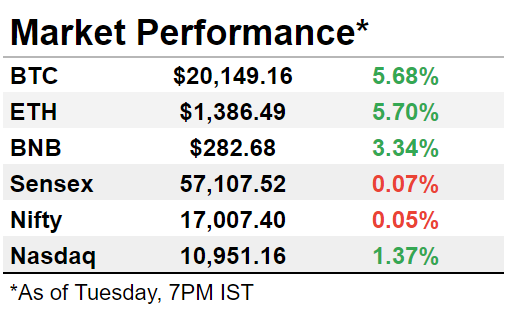

The markets were back in green territory. Bitcoin breached $20,000 while Ethereum rose to $1,390 levels. Nasdaq gained in early trade. Back home, Sensex and Nifty fell marginally.

Is MATIC The New BTC?

Polygon’s MATIC could fall 50% or rise 40%. Depends on who you ask. The Ethereum Layer-2 scaling solution is under a similar dilemma as Bitcoin. Nobody is sure of where exactly the price will go.

FYI Layer 2 is a solution that is built on top of the base layer, which is the Ethereum blockchain in Polygon’s case. Layer 2 helps reduce the load on the mainnet.

What’s really happening?

The bear market hasn’t been kind to the crypto token. MATIC fell ~73% from its December 2021 all-time high. Just like big brother Bitcoin, MATIC has seen its share of extreme price moves.

Coincidentally, MATIC also closely follows Bitcoin’s average price over a 30-day period. There is a 78% correlation, meaning 78 times out of 100, MATIC’s price will move in the same direction as Bitcoin.

But Polygon is different

Yes, partly. While it is linked to Ethereum, Polygon is considered superior because:

Cheaper and faster: Polygon can handle up to 65,000 transactions per second as against 17 per second for Ethereum. Also, Polygon just charges a few pennies per transaction.

Scalable: Polygon has upgraded to enable multiple transactions on a single protocol. This means decentralised applications can scale quickly.

Having said that, recovery is unpredictable. After Ethereum’s Merge, it was expected that Polygon would reap immediate gains. Initial signs have been seen with Starbucks’ new NFT rewards program run on Polygon. The high watermark of $1 could be some time away.

Stablecoins To The Rescue

Stablecoin exchange inflows are up, say researchers at Bank of America, which could mean that the way for the crypto market is up (fingers crossed). In a report last week, analysts at the bank said stablecoins flowing into exchanges touched $490 million the week before last. They saw a 58% seven-day increase and the third consecutive week of inflows.

Too much jargon

Well, according to BoA, “three consecutive weeks of [stablecoin] inflows indicate investors may be selectively increasing digital asset exposure.”

How does this signal recovery?

Well, serious investors consider digital currencies risk assets. Stablecoins were also regarded not-so-positively (thanks Terra), but this report signals that the attitude may be shifting.

The larger cryptocurrencies such as Bitcoin have been battered this year. But because fiat currencies back stablecoins, they are relatively easier for traders to enter and exit positions.

Have Your CAKE…

Who doesn’t like CAKE? The crypto market seems to, for one. PancakeSwap (CAKE), the decentralised BNB chain project, is touching new highs. The coin’s 24-hour trade volumes showed a sharp rise of over 52% on Monday, reaching over $55 million.

Investors are watching

PancakeSwap has been high on crypto investors’ watchlist over the last week. CAKE is outperforming most cryptocurrencies in the top 100 assets by market cap. It has also maintained its spot on the top three trending cryptocurrencies on CoinMarketCap for the past few days. Interest in the search for PancakeSwap has also been rising.

Where are we at?

CAKE currently trades at around $4.80. And there is a case for the coin reaching $5. Reports suggest it could rise beyond $5, but don’t take our word for it. Do your own research!

FTX Strikes A Deal

FTX US will buy bankrupt crypto lender Voyager Digital for $1.4 billion. The lender filed for bankruptcy in July after the Terra-led crypto crash. As part of the bankruptcy process, Voyager auctioned its assets.

Another deal

For Sam-Bankman Fried, yes. The crypto messiah is on a buying spree. In June, FTX bought the Canadian crypto exchange Bitvo. It also has the option to buy crypto lender BlockFi as part of an earlier deal.

Also, his investment arm FTX Ventures has acquired a 30% stake in former Trump staffer Anthony Scaramucci’s SkyBridge Capital.

There’s more coming

SBF is hungry for more. His firm FTX will raise $1 billion to fund more acquisitions.

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? This newsletter’s ambition is to educate (and to entertain). The world of money is changing everyday and we want to help you decode what’s happening in the world of crypto, public markets in the US and India.