3AC’s Shades of Grey

In today’s edition, USDC is overloaded, Vauld is locked up, and Crema is hacked.

Welcome to The Daily Moon. Meta’s eight-month crypto wallet trial is finally ending. Its Novi wallet pilot will be decommissioned on September 1. Users will have to withdraw their funds before that. This happens just five months after Meta’s stablecoin Diem was sold to Silvergate Capital.

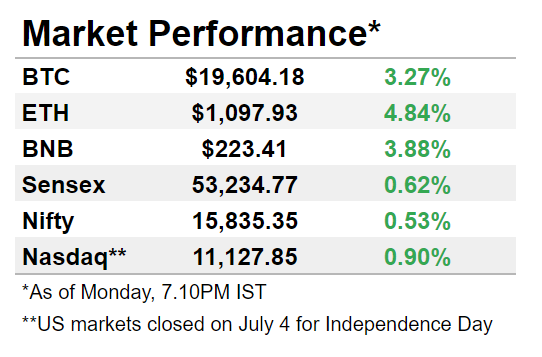

There was a broader recovery in the markets, with Bitcoin moving past $19,600 and Ethereum posting gains. The US markets were closed for Independence Day. Back home, Sensex and Nifty ended on a flat note amidst weak global sentiments.

USDC’s Ramping Up

Some lessons have been learnt from the Terra-Luna crash. Circle, the issuer of stablecoin USDC, is ramping up its partnership with traditional banks. After BNY Mellon and BlackRock, New York Community Bank will serve as a custodian for some assets backing the stablecoin.

Playing it safe

This comes just as the BTC dips under $20,000 and all major crypto assets continue in the red. USDC is the fourth-largest coin by market cap and has a circulating supply of ~$55 billion. In the stablecoin arena, USDC trails Tether.

With a 1:1 dollar parity, USDC is backed only by US dollars and short-term government bonds. Circle is eyeing an NYSE listing and hence is audited annually.

This means that its actual cash balances are also being closely monitored. Circle kicked off July with reserves worth $13.6 billion in cash and $42.1 billion in short-term securities. Roping in NYCB is also part of Circle’s initiative to highlight underrepresented financial institutions. The bank will manage $61 billion of Circle’s assets. BNY Mellon is the primary custodian of USDC reserve assets worth $45 trillion.

Stable-er than ever?

There were rumours of Circle crashing, just like other crypto projects like Terra. This was because of its exposure to crumbling crypto firms like 3AC and Celsius. But founder CEO Jeremy Allaire highlighted the difference between USDC in reserves and lending markets. He claims that Circle is “at its financially strongest”.

3AC Gets Murky

Crypto fund Three Arrows Capital (3AC) is filing for bankruptcy. From a $10 billion AUM in March, the firm defaulted on loans worth $670 million. However, TPS Capital, one of its lesser-known entities, might make the liquidation tougher.

A new culprit?

Tai Ping Shan Capital (TPS) was previously the “official” over-the-counter (OTC) trading desk of 3AC. Currently, it is aggressively active in the Asian markets. Based in the British Virgin Islands, TPS operates separately, with a little-known relation to 3AC. The firm is surprisingly absent from all discussions.

How does it affect the lenders?

TPS’s active trading means all the 3ACs assets won't go under the liquidation hammer. This could mean a substantial amount since OTCs directly connect high-value crypto buyers and sellers. 3AC CEO Zhu Su has put out his $35 million mansion for sale. After a stream of failed repayments, 3AC defaulted on paying back $670 million to Voyager. Teneo is the liquidator, but there is no clarity on the timelines yet.

There’s Another Hack

Crema Finance, a Defi protocol on Solana, was the latest crypto hack victim. A hacker chipped away $8.8 million through six flash loans on Solend. For now, Solend is safe.

What happened?

Network vulnerabilities were exploited. Crema provides market liquidity, but providers choose custom price ranges to infuse funds. Here:

The hacker used flash loans to manipulate the liquidity pool.

The Wormhole Exchange was used to accumulate the funds.

The good news is that the stolen funds haven't moved from the hacker's wallet. All activity in Crema is suspended for now. The total value held on the platform fell by $9 million in the interim. Apparently, the hacker made away with a whopping 90% liquidity in some Crema pools.

It's not just Crema

There were 251 crypto hacks worth $3.2 billion in 2021. Just halfway into 2022, $1.7 billion has been drained via 65 hacks. The amount lost per hack is 206% more than what it was in 2021.

Vauld Is Lost

Singapore-based crypto exchange Vauld is the latest to succumb to the crypto slump. The exchange is indefinitely halting all trading, deposits, and withdrawals due to financial difficulties.

What's happening?

Vauld had earned 10x its revenues over the last year. But ever since the Terra collapse and Three Arrows’ default, there’s been a ripple effect in the market. It's selloff season and Vauld has seen $197.7 million worth of outflows since June.

This drop comes just as the 1% TDS was imposed on crypto transactions in India. Overall, there’s been a ~60% drop in crypto trading in the country.

Vauld was eyeing a 5x growth in its AUM by the end of 2022. But as of now, the exchange is applying for a moratorium. There is no word on whether or when investor funds will be paid.

Help The Daily Moon get better

If you’ve gotten this far into the newsletter, I’d like to talk to you on the phone for 5 minutes. Reply to this email with a few slots, and I’ll send across a $50 gift voucher on Mudrex to everyone who gets on the call. Let’s make The Daily Moon the best newsletter!

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.

Reply to this email with a few slots, and I’ll send across a $50 gift voucher on Mudrex to everyone who gets on the call. Let’s make The Daily Moon the best newsletter!

Reply to this email with a few slots, and I’ll send across a $50 gift voucher on Mudrex to everyone who gets on the call. Let’s make The Daily Moon the best newsletter!

Where To Reply ?