3AC’s in a mess

In today’s edition, Three Arrows Capital caused its own downfall, and DeFi gives a breather.

Welcome to The Daily Moon. It’s a brand new week. And if you are in the UK, be ready to be sued via airdrops. A law firm is already gearing up to serve a legal notice to an anonymous individual through blockchain. This person allegedly stole a fair number of crypto tokens.

Moving on, today we talk about Three Arrows Capital's ill-conceived business model, and DeFi's shining moment.

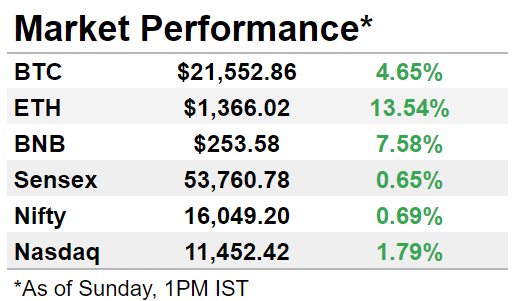

The markets ended on a positive note, with Bitcoin reclaiming $21,000 and Ethereum at ~$1,350 levels. Nasdaq ended on a high note following encouraging data on consumer sentiment. Back home, Sensex and Nifty snapped out of a four-day losing streak on a revival in buying interest from foreign funds.

Image by Sergei Tokmakov Terms.Law from Pixabay

What went wrong at 3AC?

Ten years ago, when Su Zhu and Kyle Davies started a crypto hedge fund, it was virgin territory. Crypto was in its early stages of growth. Bitcoin was just teething, valued at merely $13.45 in 2012.

Zhu and Davies named their venture Three Arrows Capital (3AC). Between 2012 and 2022, its net asset value grew to $18 billion. Hedging was getting hotter and seemed like 3AC was on its way to the pinnacle of success.

But in May 2022, the Terra-Luna crash caused mayhem. 3AC was caught unaware. Publicly, it admitted to losing $200 million to the fiasco. But most experts peg this amount at a whopping $560 million. Now, 3AC has filed for bankruptcy and the founders are missing.

The origin story

Set up in Singapore, 3AC started off on a vibrant note. Its strategy was to borrow heavily from industry and invest in crypto projects. Aggressive leveraging was at the core of 3ACs functioning.

FYI: Leveraging is a popular strategy used in crypto and other forms of trading. Here, investors trade via borrowed capital to maximise returns. 3AC gained higher exposure to the crypto market by leverage or borrowed funds.

Zhu, in particular, was very big on the “supercycle” theory. He envisioned crypto prices constantly skyrocketing, thanks to younger investors entering the system.

Why did it fall?

3AC had a “substantial” investment in Terra. So when Terra collapsed, 3AC was in a bind. The hedge fund had to start repaying its lenders and the only way it had was to dump its staked Ethereum. This was the last straw. When 3AC hit the panic button, talks of insolvency started to emerge.

There were a slew of factors for the downfall of 3AC. But, lenders blame Zhu and Davies for the way business was conducted. Let’s break it down.

Over leverage: 3AC was leveraged very long on all its investments. With crypto hitting rock-bottom, the fund's financial vulnerability came to light. The fund began ghosting and defaulting on loan and interest payments.

The Terra impact: The Terra-Luna crash wiped off $60 billion worth of investor wealth. Suddenly, 3AC realised that they had lost millions in this fall. Once reality set in, 3AC fell woefully short of paying back the rush of investors at once.

No Plan B: Riding high on risk and momentum, 3AC was heavily leveraged and excessively reliant on debt. As crypto prices started to dwindle, its assets fell from $10 billion to $3 billion just between January and April 2022.

By mid-June, 3AC was unable to meet the “margin call”, meaning it couldn’t deposit more funds to trade. Crypto firms such as BlockFi, Blockchain.Com, Genesis and Voyager slumped immediately, citing exposure to the hedge fund.

3AC filed for bankruptcy on July 1. Voyager Digital, which lent $675 million to 3AC, followed soon after. Now, DeFiance Capital, which once had links to 3AC, has stated that it is “entirely separate” from the crypto hedge fund.

What’s the future?

3AC’s assets will be seized, a US court has allowed liquidators to start the procedure. Amidst reports of the founders vanishing, Zhu resurfaced on social media to blame the liquidators. He claimed that while blockchain scalability solution StarkWare’s StarkNet token was to be used to repay losses, the liquidators did not exercise the option.

Currently, creditors are keen to get advisory firm Teneo to oversee 3AC’s Singapore assets. The first meeting of the liquidators will be held under court supervision on July 18. For now, Zhu and Davies seem to have washed their hands off the crisis.

DeFi Extends Fleeting Hope

Large interest rate hikes are likely. But DeFi is offering a helping hand to worried investors. DeFi crypto such as Aave and Uniswap outperformed Bitcoin and Ethereum in the 24 hours ended July 15. While DeFi’s market cap dropped, user activity is buoyant.

Building on rates

Amidst rate volatility, Aave has proposed a yield-generating stablecoin GHO. This will generate additional revenues for Aave DAO.

Simultaneously, Uniswap saw ~10% price rise due to the dual factors of hike expectation and addition to Robinhood’s crypto trading platform. DeFi offers yield farming, wherein users can stake crypto and earn higher yields.

Down but not out

There was a ~75% drop in DeFi market cap in Q2. However, the industry was able to retain its daily active users at just below ~30,000 levels. Celsius’s withdrawal freeze also helped DeFi protocols add new daily users.

Help The Daily Moon get better

If you’ve gotten this far into the newsletter, I’d like to talk to you on the phone for 5 minutes. Reply to this email with a few slots, and I’ll send across a $50 gift voucher on Mudrex to everyone who gets on the call. Let’s make The Daily Moon the best newsletter!

And that’s it for today. If this email was forwarded to you, please consider subscribing. It’s free. We’ll never show you an ad or charge you for this. We swear.

Who are we? There is a lot happening in our world. Everything has layers, and each layer has to be carefully peeled so you, the reader, know how the world of money is changing every day. That’s our promise. Help you unpeel the onions, which are the public markets in the US, India, and crypto, so that you know just a little more.